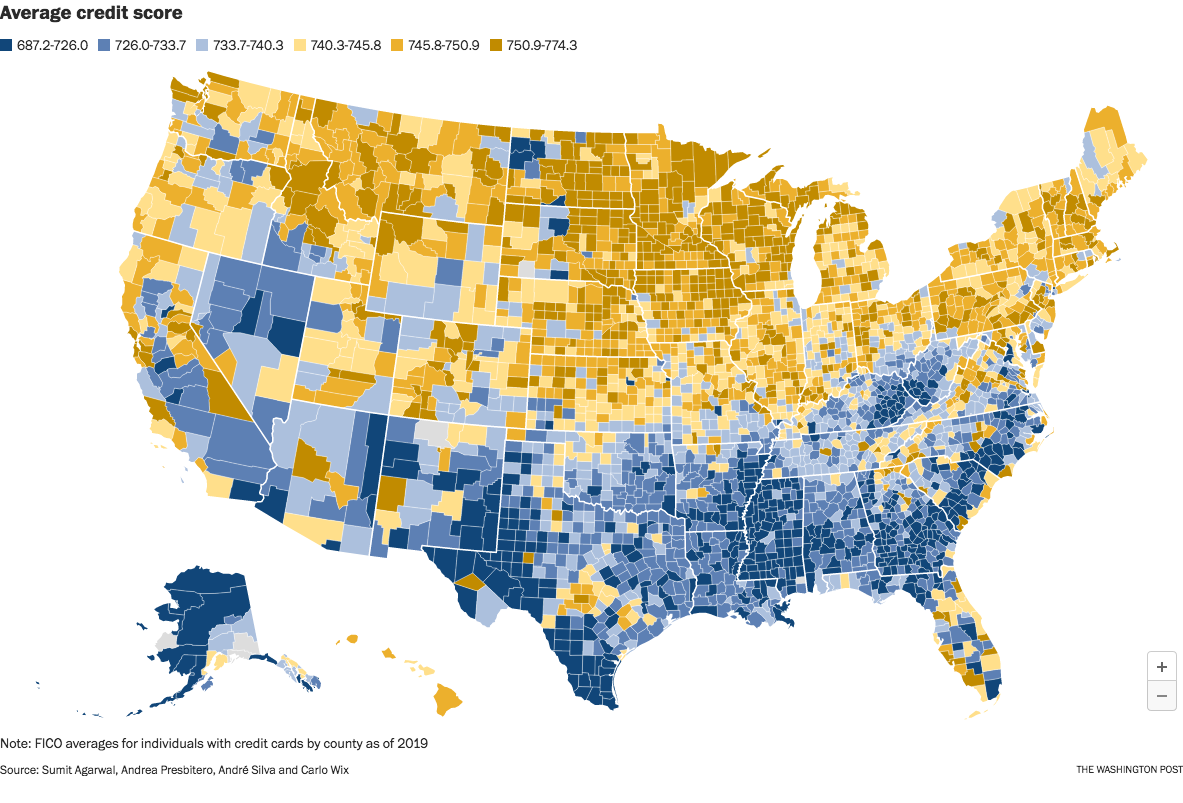

The image is from a Washington Post article which took the data from an interesting research paper titled Who Pays For Your Rewards? Redistribution in the Credit Card Market.

The research paper is a good read. (A free PDF of the whole paper is available at the link.) It examines how the use of rewards credit cards results in a massive wealth transfer from low-credit-score customers to high-credit-score customers:

We estimate an aggregate annual redistribution of $15 billion from less to more educated, poorer to richer, and high to low minority areas, widening existing disparities.

The Washington Post article attempts to frame the clear north-south split as a result of healthcare issues in the south. That explanation seems too narrow to me. This map looks too similar to maps of poverty and education, and we know health correlates strongly with both of those issues.

Edit to fix a sentence fragment. Sorry; it was late and I was tired.

Could be a choice to reflect the distribution of different scores. I can’t imagine credit scores are a very linear distribution.

It also doesn’t go low and high enough. The first and last category should show everything below and everything above respectively.

I mean a 687 credit score isn’t ideal but it’s far from how bad it can get.

It’s showing averages. Just because certain scores are possible for an individual doesn’t mean there’s a district somewhere with that average score.

My credit score is not shown here because there is no district with that average score.

Makes sense, thanks.