Negative Income tax could operate like UBI. The hero of neoliberalism Milton Freedman supported a scheme to transfer wealth like this.

but what about -~- LOOPHOLE WHACKAMOLE -~- its not technically free for billionaires since they have to pay so much to lawyers

Please edit the title of your You Should Know post to begin with “YSK”. It’s Rule 1 of the community. Thank you.

Thank you

Don’t give the super wealthy any ideas.

As an example: this exists in Flanders (dutch speaking part of Belgium): https://www.brusselstimes.com/316484/job-bonus-for-730000-people-in-flanders-how-to-make-sure-you-get-yours

The US doesn’t technically have a negative tax, but the EITC accomplishes the same basic thing. Whether it’s efficient enough, or needs expansion is another story.

What are the upside of that vs plain minimum wage?

It reduces the onus on businesses and places it on the government (and this indirectly, taxpayers).

Better for small businesses to hire and thrive.

“But I don’t want my taxes to go up!”

Maybe you just need more tax brackets. Where I live, for some reason, a specialized doctor making $250,000/yr is in the same tax bracket as some C-suit making $900,000.

I definitely need more tax brackets where I live.

Never understood the idea of tax brackets. Why isn’t it just continuous? Computers are calculating the tax now anyway, not like it would be infeasible.

I mean to a degree it is continuous. To simplify things the first $10 you make isn’t taxed. $11 to $15 is taxed at rate A, $16 to $20 is taxed at rate B, etc. This is what is meant by the progressive tax system. Obviously these numbers are much higher in reality.

People who can’t understand this are the ones bragging that they turned down a raise because it would “change their tax bracket”. With one exception at very low income, called the benefits cliff, the more money you are paid the more money you take home after taxes.

Does this make tax brackets less confusing? I want to help you and anyone else reading to understand.

I think what they’re saying is that it shouldn’t be in steps, the tax rate should increase as income increases.

So $11 would be taxed at A.2, $12 at A.4, $13 at A.6 and so on. And $11.50 at A.3.

As it is, it’s more discrete than continuous (from a mathematical perspective). Another problem is that it usually stops. Like where I live, and it tops out at about $250,000.

Yeah I get what they mean but that’s much more complex. I suppose that’s what computers are for but it could make it even harder for people to understand and so many people do not understand the current system.

Definitely agree we need more brackets after the top one. Although this only goes so far, as the more wealthy a person is the more likely their income isn’t classified as income anymore. I’d love to return to post WW2 tax rates on the rich but we need to do something to make them pay some kind of fair share. It’s disgusting what they get away with.

Sounds like a nightmare to try to explain to someone. Technically it should work, but practically it might be difficult.

Why? To me it’d be much more intuitive. I find brackets quite confusing

The brackets are pretty simple. It’s percentages and subtractions. Think “buckets” that spill over in the next when they’re full, and each “bucket” has a larger percentage that’s taken as taxes. Keep the numbers small so its easier. Imagine that there are three brackets. 0-100$ pays 10% tax. 101-200$ pays 20%. 200$ and more pays 30%.

Someone who wins 150$ pays 10% on the money they made from 0 to 100$, and 20% on the 101st dollar until their last, so they’ll win 150-10-10=130$ after tax. They didn’t win more than 200$, so no money gets taxed at the third bracket’s rate.

Say that person wins 250$ next year. Their first 100$ will result in the exact same 10$ in taxes. Their 100th to 199th dollars will be in the second 20% bracket. Their remaining 50$ falls in the last bracket, so gets taxed 30%. They will therefore this year make 250-10-20-15=205$ after tax.

Said person gets a big promotion and is now making 1000$ the third year. Their first 100$ gets the same 10$ tax, same for their second 200$ with the same 20$ tax. They have 800$ left in the last bracket, which at 30% means 240$. So they’d be winning 1000-10-20-240=730$ that year.

How would an infinitely adjusting tax percentage be intuitive? Brackets are simple. You pay x% on your income in some bracket and y% on your income in a different bracket. You only need simple multiplication and addition to figure out what you would owe.

Brackets are lobbied for. You cant lobby a straight line.

Tax brackets are there for progressive taxation. Progressive income taxation is the most fair form of taxation. The least fair is consumption tax - such as sales tax. Sales tax tax disproportionately burdens lower income households. Since most places have sales tax, an aggressive progression of income taxation is called for to balance the scales.

Could totally do a sigmoid function and just integrate over the income. But the brackets are just discrete approximation of that.

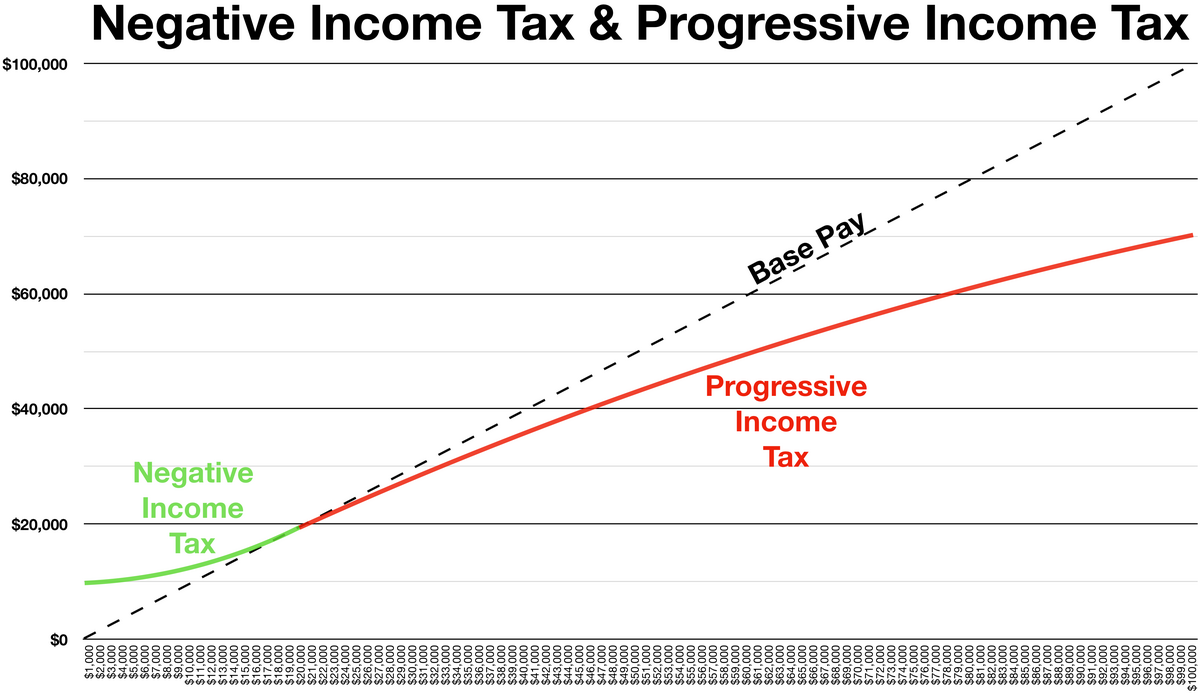

What a bad set of graphs! The first one is just wrong.

In what way?

The tax is never negative. Instead, it plots a progressive tax rate, and calls it “negative”.

The second graph is just confusing and detracts from the explanation instead of adding to it.

That graph plots gross pay (x-axis) against take-home cash (y-axis). The far left of the graph (in green) shows people making under 20k taking home more than their “earned” pay. At the extreme bottom is somebody making 1,000/year taking home 10,000. The progressive income tax starts at 20,000.

Not labeling the axises does make it hard to read.

Oh, that’s right. Yes, the graph is only bad and not wrong.

Good thing it’s a wiki!