When I was young, I was poor. But after decades of hard work, I’m not young anymore

I used to be poor. I’m still poor, but I used to be, too.

The absence of affordable housing is a failure of the state. working your whole life to pay for housing is the rigging of the system.

It’s intentional. We are all just serfs

Removed by mod

More like “put the company’s wants before your own needs”.

And now anyone that has beef with him can make a copy of his keys and waltz in the front door.

I don’t love that I saw this post and the very first thought I had was that I hope those aren’t their actual front door keys.

The trick is finding his front door

Edit: and we all know from this post op has no assets

Wow, and that’s a really tiny house too. Couldn’t even get a whole hand through the front door.

Obviously wasted too much money renting that large hand.

deleted by creator

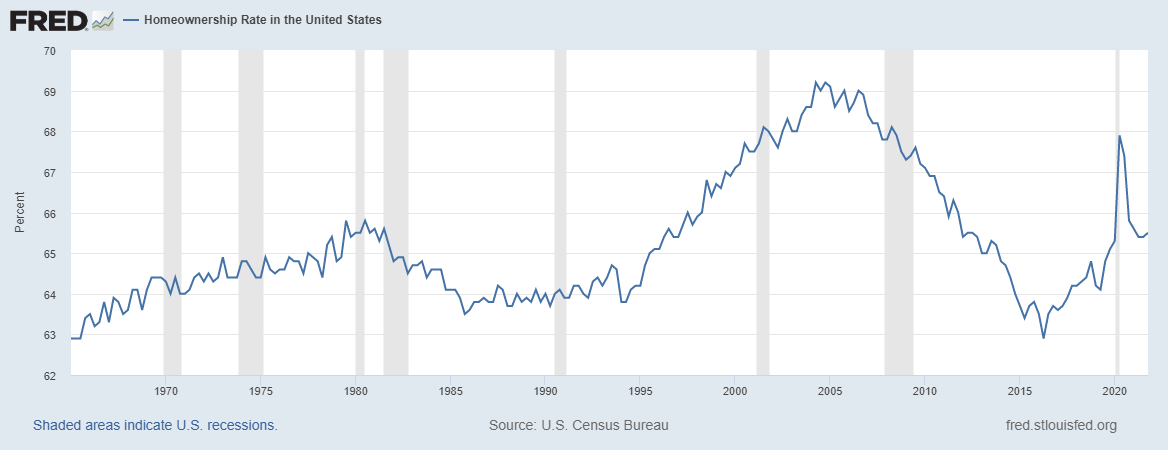

Home ownership in the US has hovered between low 60% and high 60% for around 6 decades now, but sure, let’s pretend that it ain’t possible no more because some people only want to post doom-and-gloom bullshit because they have ulterior motives.

What are the statistics for those under 35 though? If I had to guess, the 65+ crowd is propping up these numbers.

The people who are 65 now, would have been 35 in the mid 90s. Home ownership in the mid-90s is within a few percentage points of what it is now.

And when it comes to home ownership of people around 25 years old, there are more of them now, than young people 20 years ago.

“Almost 30% of those young adults owned their homes in 2022, more their Gen X parents achieved when they were 25”

The fascists don’t want facts though they just want to bitch about the state and get free things.

A similar proportion of people are buying houses, but they’re paying far more relative to their income than used to be the case. People are stretching their budget more.

People are also buying later than used to be the case. “Starter homes” aren’t a thing anymore. People are buying in their mid-career after saving a ton of money up. https://www.urban.org/urban-wire/real-homeownership-gap-between-todays-young-adults-and-past-generations-much-larger-you

Just referencing the homeownership rate alone ignores the important context.

Interestingly your link seems to blame it mostly on declining marriage rates? It says near the end that the majority of the decline in individual homeownership rate since 1990 can be accounted for by assuming the marriage rate stayed constant, rather than the noted decline in marriages we’ve seen since then. So I’m not convinced things actually were better in the 90s; couples were just getting married younger and more often, and the pooled resources allowed more of them to buy homes.

Is that not the definition of better lol

But you can just look at the ballooning cost of homes, far outpacing wage growth, to see it’s mathematically inevitable that it’s worse.

Ignoring everything else wrong with your comment, have you considered the original tweeter might not have been American?

What do you mean not American? There’s only America, what else exists in the world?

I know there is a south America also. Not sure about anything else.

But it is not the best America, so we don’t care

Considering 95.8% of the humain population lives outside the USA… It’s easy for Americans to forget they’re actually a minority in the world because math is hard!

Clearly you ignored the fact that I specifically stated these were US numbers on purpose because while the photo looks like the UK, they didn’t call out where they were talking about.

The problem I see with that graph is that it tells us that 63%-69% of Americans are incentivized to make the problem worse. Homes are, by far, the biggest asset of those people. Their retirement and long term wealth is highly dependent on appreciating housing prices.

We regularly observe the effects of this in the form of all kinds of NIMBY laws. Unless you’re prepared to build a cabin in the middle of the wilderness, almost all the desirable land already has a bunch of people living there. Those people tend to be very resistant to any additional housing that has any chance of decreasing their home value. We also see it in the form of mortgage tax deductions. The more money you borrow for your house, the more the government pitches in. We’re encouraged to leverage our investment in housing which further drives up the need for housing to be a good investment. All of this effectively turns into a negative marginal tax rate (ie it’s a wealth transfer from poor people to rich people).

We, as a society, need to decide if we want housing to be a right or an investment. It can’t be both.

We, as a society, need to decide if we want housing to be a right or an investment. It can’t be both.

We already decided. We decided it’s an investment, fuck human rights.

Or did you not notice all the homelessness?

Unfortunately it’s far more complicated than that.

Many of those people who own homes aren’t rich themselves. If you look at the income distribution in the US you’ll see that (even if we make the assumption that only the richer people own homes) homeowners could be earning as little as $50k, for their entire household. Only about 15% make over $200k. For the rest, if their homes don’t do well as an investment, they’re absolutely screwed as they get older.

I do notice homeless people but it’s not a good way to estimate homelessness rates. Depending on where you are, that’s likely to wildly over- or under- estimating homelessness. Some cities effectively have policies of moving homeless people to less visible spots, either through sheltering or though relocation. That’s part of why people think SF has a rampant homelessness problem even though NYC actually has a hire homelessness rate. Homeless people also tend to congregate in certain areas for a variety of reasons (winter weather is a big one). Homeless rates in the US have stayed pretty steady over the last few years. https://www.huduser.gov/portal/sites/default/files/pdf/2022-ahar-part-1.pdf Globally the US is on par with many countries that typically go through a lot of pains to protect citizens rights; eg Germany, Austria Denmark, the Netherlands.

I suspect that the bigger effect is under housing. That is, people staying in homes that are no longer suitable for them.

The upside is that there’s a very simple policy that is highly likely to have an enormous impact on all variations of housing shortage, build more houses. Credits and incentives only shuffle around the existing stock. Housing vacancy rates are near historic lows. Fix that and house prices will come down. A lot of people don’t like that plan because it seems to capitalist. But, as I said at the beginning of all this, we would then need to find a way to help all the people who’s retirement plan we just nuked. There are fairly straightforward ways to do that too. A lot of people will hate those plans because they sound too communist. My best guess is neither will happen and we’ll keep plodding along with the suboptimal status quo.

just buy a house! pay your own mortgage, not your landlords mortgage.

oh yeah that’s so easy. why didn’t i think of that? i totally forgot i’ve got a spare $100k over here i can use for a downpayment.

Oh man, near me you need ten times that for a small two bedroom…

pretty sure small houses are not $5 million unless you live in Monaco

100,000 * 10 = 5,000,000…

Checks out

i’ve got a spare $100k over here i can use for a downpayment.

reading comprehension

The confusion is between the full price and a downpayment of 20%.

It’s amazing how fast the savings build up when we cut out avacado toast!

Sure, should I ask mommy and daddy for the money, or just prance out to the money tree and pluck a few hundred grand?

Hey, can you grab a bushel for me while you’re there? We’ve been eating a lot of money salad so we’re running low.

Get some extra so you can pay the extra few thousand a month more you’ll be paying on your mortgage

This is the main problem with this generation. Everyone is just complaining about the lack of money and all that but I hardly ever see anything about planting a money tree or two on your property. Sure, it takes some TLC to get it to grow but it’s worth it come harvesting time. People are just lazy that’s all.

Not gonna lie, you had me there in the first half. 😜

That or Only Fans.

Landchads can’t stop winning 🤣

And it always ends in tears, burning of debt records and redistribution of the land.

Actually, it almost never ends that way lol

Historically though, how does this end?

I guess we have never had a global property crisis before

Typically it ends in rich people gobbling up even more property, money, and power, while potential competitors don’t have the resources to weather the troubles.

Winning a piece of lead in their stomach or a piece of steel through their necks?

This but sad. People seem to love paying rent

I’ve never heard of anyone who loves paying rent. They just don’t think they can do anything about it when it gets raised.

For some people rent is the smarter option. If your moving around every two years anyway for work you’d lose a lot of time and money on fees and taxes buying and selling. Home ownership should for sure be more accessible though.

Housing is a human right, and should in my socialist inclined opinion be a state business.

The de-commodification of housing is incredibly based.

i agree, but unfair market monopolies and lobbyism is what caused the housong crisis in the first place and those will continue to exist in other economies as well if we don’t legislate against them. the free market gives people the power to fuck over others. people have forgotten to include the philosophical counterpart to “as long as it doesn’t infringe upon the rights of others” in their capitalism because they were too busy cooming over their agency

the US and humanity as a whole is too tribeminded to instinctively act cooperatively across communities, and especially borders, which is why we need to systematically make it impossible for anyone to be left in the dirt. there is no human we do not have the resources to give a happy and fulfilling life, so anyone asking for more at the cost of that should be fucking beheaded, if you’re serious about minimizing human suffering.

Even if you plan on staying put, sometimes the math just doesn’t work out. Renting is, for me, much cheaper than buying, even accounting for equity. Depends on the housing market in your area.

deleted by creator

Removed by mod

I’m guessing it’s mostly about building equity. The average net worth of a home owner is $225k, while the average net worth of a renter is $6k. You can usually get a lot of the money you pay for your mortgage back if you really need to (and likely much more long-term, if the housing market isn’t down). And you can do whatever you want with a house you own (change flooring, remodel, make garden beds, install solar panels, build a workshop, etc).

Renting makes sense if you plan on moving again within the next 5 years, or if you are very high income, can build significant equity while also paying rent, and just want everything taken care for you.

Removed by mod

Having owned a condo - I can’t honestly recommend them.

You’re beholden to an HOA in every way that can charge whatever they want.

I was paying $600/month for a green pool, a broken grill, and an ‘unassigned’ parking spot.

My place flooded 7 times in 6 years due to ‘unforeseen circumstances’ with no recourse because there is no way of knowing which of the 15 units above me leaked, or if it was a central pipe.

It sucked dick

deleted by creator

Removed by mod

deleted by creator

Removed by mod

Remind me when this guy’s 79 can’t work anymore and can’t afford rent on the shitty retirement they have and let’s see if they wish they had a fully paid off house by then 😂

deleted by creator

deleted by creator

As someone who bought an outdated house in 2013, I agree with you, in part.

The amount of money that my husband and I have sunk into this house between having the foundation leveled, having the entire house re-plumbed, updating the flooring, updating the siding, updating the windows, having the gutters re-done, new HVAC…among the various other things that my husband and I have done ourselves (some of the flooring, repainting, updating kitchen sink+hardware, updating both bathrooms, new Hot Water Heater etc), we’ve sunk ~$85K over the past decade. Fortunately all those hits didn’t come all at once. Right now we’re in the process of paying off financing for the siding, the flooring we had professionally done, and the plumbing. Only 2 of those things were planned and budgeted for. The plumbing issue occurred the same month we had the siding and flooring done 😮💨.

That being said, on the other hand, I do see the value of being a property owner. When I look at the appreciation on the property and know that I have that money if shit ever goes super sideways for me, I’ll be able to survive long enough to figure shit out, its comforting. Seeing my mortgage go down and knowing that if I ever need to sell, I’ll get a large lump sum, is also comforting. Or, if I have to live in this house forever for some reason, at least it won’t be mortgaged anymore, so that will be a relief in my old age.

Then again, you’re right about the property taxes too. I’m paying about $460 a month in property taxes, but I’m only 10 years into my mortgage. Who knows how much I’ll be paying a month in 20 years as housing appreciates and taxes go up? It’s not inconceivable that it would get to $1K a month or more. That’s essentially a rent anyhow. Plus I’m still on the hook for all the stuff that will need updating 20 years from now.

I agree that people think that home ownership is some easy ticket to wealth without taking into account how expensive maintenance is. I also agree it can be valuable just by virtue of security (your principle and interest remains stagnant, and you never have to worry about your lease not being renewed.)

And before people are like “You just spent so much because you bought a lemon house. Being a home owner isn’t that expensive when it comes to house maintenance.”

No. My house was never unlivable, and all my maintenance issues occurred at different times over the course of my decade of home ownership. My house was built in 1995. The HVAC went out in 2017. It was 22 years old. That was ~$6K. The foundation needed leveling and the gutters needed replacing in 2021, that was another $12K between the two. Getting all the windows updated to a thicker more efficient glass with better sealing occurred in 2022, 5 windows and a back door was $20K. Started noticing the rear siding looking janky in 2022, and didn’t want to defer maintenance so had that replaced, that was $20K. The plumbing went out in 2022, and it was a leak under the foundation. They offered to patch the plumbing but would only warranty the work for 3 years, or they could replumb the house and warranty for 30 years. That was again, just under $20K.

The house is nearly 30 years old. You can’t defer maintenance like foundation leveling and siding if you want your house standing when your mortgage is paid off.

All of this was a suuuuuuuuper long winded way to just say: Yes I’m a home owner. I plan on selling the moment I’m allowed to escape this state, and no I never plan on owning ever again. I actively want the flexibility of renting and being able to up and move the moment my lease is over if I don’t like the place. And I never want to worry about major upkeep ever again.

Removed by mod

I hate renting with a passion and wish I could buy a home of my own, but that is the one silver lining. I’ve gotten home after a 14 hour shift and realized that something was wrong with the hot water heater. Put in a ticket with maintenance, gone to bed, and at 9 am the next morning they’re knocking on my door to fix it. I don’t have to deal with the mental load of even thinking about who to call let alone the financial headache of paying for it. I was also extremely lucky that in that case I lived in a place with amazing maintenance people.

I don’t feel secure that my state won’t pass horribly restrictive laws driving me to leave in the next 7 years which makes the financial decision to buy not necessarily worth it