- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

Summary

Donald Trump announced new tariffs against China, Mexico, and Canada, sparking market turmoil as the measures were set to begin this weekend.

Following the announcement, major indices plunged, with the Dow Jones, NASDAQ, and S&P 500 suffering significant losses, reflecting investor anxiety across global markets.

Canada, Mexico, and China vowed retaliatory tariffs, with officials warning that these measures could escalate trade conflicts and significantly harm economic stability.

Critics argue the tariffs will harm consumers and businesses, creating global trade uncertainty and risking prolonged economic challenges in the United States.

Critics argue the tariffs will harm consumers and businesses, creating global trade uncertainty and risking prolonged economic challenges in the United States.

God damn it media, can’t we just call a fucking spade a spade. Anyone with a fucking functional brain knows these tariffs will harm consumers and businesses. “Critics,” my ass. Informed people, more like.

It’s this kind of shit that allowed us to get here to begin with, an unwillingness to just say the painful, obvious truth and speak it to power.

It will harm consumers and small businesses way more than it will harm the big corporations. And that’s exactly the goal: consolidate the government by crippling their biggest enemy in the middle-class. It’s how fascism operates: make sure only your supporters survive.

The big corporations already planned their loopholes into the order. For them, this helps them consolidate power by driving smaller businesses out, or to where they’re forced to sell.

Hanlon’s Razor does not apply to this administration. It is malice. They know exactly what they’re doing.

There are lots of good opinion pieces out there that satisfy your needs in that regard, but at its core, journalism should just be taking sources and presenting it in a way that people can read easily. Newspapers usually dont claim anything themselves, they just repeat claims made by other people. Thats not a bad thing, thats just how this works.

It is a bad thing to platform viewpoints that are incorrect or that shouldn’t be spread

Journalism should be, but does not currently. Newspapers usually, as in decades ago, but do not currently.

I’m looking at both the dow and the nasdaq, and they look fine. Where is this “plummet” the article is referring to? Not that I think the tariffs are good, but let’s be truthful.

Not exactly what I would classify as a plummet, but we were seeing green numbers for the day and then they subsequently turned down once this was announced.

Still too early to say whether we’re going to be looking at any form of sharp downturn.

Right? -0.5% yesterday, -1.0% for the week. Totally normal and not deserving of any kind of adjective.

Certainly not saying Lady Trump’s actions won’t kill the stock market, but this ain’t it yet.

Press: ryrybang slams New Republic article!

Starting just after 11 AM EST, the S&P went down over 1%. It’s not a steep plunge; that kind of swing happened on Monday for AI, too, IIRC.

Going down less than one percent is the opposite of a ‘plummet.’ It is literally indistinguishable from a normal daily fluctuation.

Furthermore, the market has overall gone up since.

OK but they did fall rapidly, and one can only surmise it’s because of the announcement of more tariffs.

The market is driven by emotion, which is why doing anything other than long term investing is risky. I’m sure the fluctuation was connected to his tariff announcements. You want to see a real fall? Wait until the tariffs become a thing and people realize he’s screwed up a functional system. I wonder how fast one can backtrack such things? If it wasn’t for the harm done to so many people, I’d love to see if it’s a Brexit level mess, or just a temporary hiccup once they reverse course.

Seems more like a Liz Truss level mess. Unfortunately, unlike the UK, in the US system it’s effectively impossible to remove their leader from power. So they’re stuck with him even after he craters the economy.

Right, absolutely. I’m not saying that Herr Drumpf just kickstarted a recession and neither do I think that’s the claim that the article is trying to make. The market, however, had a very clear reaction to just the MENTION of tariffs. What happens when the details to these tariffs are released? What happens when they are actually implemented?

It will react with more details similarly. Like I said, it’s putting them into place that’s the real hit, and it will be much more than a stock market drop. I suppose tariffs do have a place in some circumstances, but he’s throwing darts, and none of them are stuck in the target.

Darts implies at least some degree of precision. This is just flinging shit wildly in all directions.

Why are you posing as an authority on this? Its painfully obvious youre talking out of your ass.

I never said I was. Trump promised tariffs on EU countries and stocks went down. I’ll grant you they didn’t go down by a lot, but I don’t think the article was being disingenuous.

Just an anecdote, but I sold all my SPY yesterday. I kept some more conservative investments in but I think once people see inflation from the tariffs it will drop.

DJIA shorts are up 347% seems a lot of people are leaning towards a downside

Not sure what the article is talking about. I’m sure once tariffs are announced it will drop tho. But that’s a problem for monday.

deleted by creator

Hold on now, that was a NASDAQ loss of nearly 0.75%. If the Americans do that 134 times in a row, all their money will be gone! How would they buy their eggs? /s

(1 - 0.0075)^134 ≈ 36.5%

If you’re going to “well, ACKchyuallllly” someone, it helps to have any idea what you’re talking about.

The DOW “plummeted” 337,47 points from 44.882,13 to 44.544,66, a reduction of ~0,75%. Given the drop wasn’t percentage based but was additionally expressed as a percentage of the previous closing price for context, it would require an additional ~132 similar drops to reach zero.

Now, you’re probably noticing I listed the DOW and ~132 drops here versus NASDAQ and 134 drops prior. That’s because I was making a joke and was not much concerned about details. This is because, unlike certain individuals, I am not one of the most insufferable types of people: the pedant.

Right. The S and P 500 went down 0.5% yesterday, it’s a pretty typical trading day and still up over the last five days, month, six months and the year.

Trumps a lunatic, but one thing he does understand is business.

Numerous failed businesses and bankruptcies beg to differ.

What Trump understands is marketing. A stupid enough audience, tell them lies with enough confidence, and they will let Trump fleece them like sheep.

Trumps a lunatic, but one thing he does understand is business.

This is mostly a branding thing, he’s not actually particularly good at running businesses.

I’ll give him that he’s somewhat of an expert in avoiding any form of accountability.

Mother fucker bankrupted a casino. He knows absolutely nothing about business.

Bankrupted three casinos: Trump’s Taj Mahal, Trump Marina, and Trump Plaza.

He seems to understand shell companies, tax avoidance, cheating your contractors, and strategic bankruptcy. He understands shilling for sponsors buying and selling favors, fleecing the rubes. I guess those are business strategies but there’s no evidence he understands ethical business.

Could this finally be the term that Trump speedruns the economy crash so the Republicans can be properly blamed for it happening due to their policies and leadership, rather than the Dems always inheriting a timebomb and wasting a whole ass term fixing it?

Trump is already running with the line that the helicopter/plane collision was somehow Biden’s fault, even though Trump and “Justin Hammer” fucked with the FAA. That’s probably why they are speedrunning this collapse, they want to claim they inherited a mess, and shift blame for the consequences of their actions.

Just to be clear that’s not what happened this last time. Biden deliberately took away all of the covid provisions that were holding the economy up. And while the inflation wasn’t directly caused by the government at the time, democrats did nothing about it except wait for studies to come out showing it was price gouging so they could say it wasn’t their fault.

Are egg prices plummeting?

Where are all of the “I’m worried about the economy” voters at? Come on be loud and proud!

We need to seriously start planning states breaking up from the federal government.

California already got the ball rolling

If the don’t plan on seizing nukes then they’ll end up like Ukraine…

Yeah, the scenarios where a breakup of the union is feasible are… limited. Governors aren’t going to be able to seize the nukes or military assets needed to establish themselves on their own without some truly extraordinary changes that just haven’t come into being yet. Maybe one day, but it’s going to be a damned rough road before we get there.

Ah yeah, great plan, let’s fracture the empire while major corporations look on like vultures circling a corpse.

The sad truth is that without a strong, united US government, corporations are going to sieze complete control of any offshoots.

Have you not been paying attention? Corporations already run this country.

It can get worse.

One of the funniest things I read was a WSJ article on tariffs, in the comment section. Along with a lot of copium about how they, personally, don’t buy such items, some dumbass bitching that WSJ - that’s right, the Wall Street Journal - is showing their bias against donvict.

The ONLY gloom and doom articles I saw in WSJ during Biden’s high inflation term were in the opinion section. Your bias is clearly showing …

Apparently, reporting on items likely to be affected by the donvict taxes on goods is “bias”. That WSJ, always known for their extremist progressive WOKE agenda and their “TDS”. LOL

If you are a non-Trump voter in a red state, especially if you work for the flagship company or industry in that state, I would like to apologize on behalf of all Canadians for what our government is about to do. We don’t want to do it but it is the only way to deal with a bully.

I would like to apologize on behalf of all Canadians for what our government is about to do.

Awfully nice of you Canadians to apologize in advance for defending yourselves - eh?

It’s what we do. We understand that most Americans didn’t vote for him and that those who did don’t understand tariffs or just how much the damage that he and the billionaires are doing to the government is going to hurt regular Americans, including his base, for decades to come. It sucks but here we are.

deleted by creator

We don’t want to do it but it is the only way to deal with a bully. I think tariffs are bad for the people of the country that levies them. If another country puts a tariff on things my country sells, I’m for unilaterally disarming. Let the other country’s people enjoy the dubious industry-protecting benefits of that tax, and let us enjoy the benefits of buying whatever is a good deal.

I think it’s nonsense to think that when people freely trade money for goods, the person receiving the money “wins” and the person receiving the goods “loses”. They made the trade because it was good for both parties.

I’m American, and we’re pursing the opposite of what I think is good policy.

Tariffs are the opposite of a “free market” measure and absolutely choke an interconnected economy. Look at the damage done to Cuba or North Korea by sanctions, it’s the same principle. Getting to the real meat of why this is happening is like a forensic case study. Doesn’t even benefit Trump unless he basically immediately reverses it and gives the old “see they capitulated to my demands” based on whatever random thing he dredges up.

It helps folks who are positioned to buy the dip.

As long as the stock/asset/etc. actually goes back up, yeah. And yeah, you can short a decline as well.

Just another opportunity for the oligarchs to buy more of our country at a discount!

And hedge funds keep betting against the fucking economy. 401ks, savings, and pensions will all be effected. They want to steal your money.

All I hope is that Americans grow the balls for a general strike.

There were plans for May 1st 2028 since three major unions are renegotiating at that time.

I’m not sure it can wait four years.

Trump or someone exactly like him will be re-elected in 4 years.

There won’t be elections in 4 years

I think we will have Hungarian or Venezuelan style “elections”.

Nah there will be, but it won’t make a difference. Why stop when they keep winning?

It didn’t “plummet” lol its less than a 1% change

But we only have 99 left!

99 to go!

Here we goooi! To the floor!

Then back up for that growth and profit!

Markets have been closed since Friday. Come Monday, we’ll see what’s what.

Literally this, it’s hard to take this messaging seriously with these kind of declarations

It hasn’t even begun to drop, LOL. Wait a couple of days.

Lololololololololol, fixing worthless Trumper pretending it’s not a big drop because percentages

I didnt say it wasnt a drop. I just am pointing out that it’s not really a “plummet”

And I’m the opposite if a trumper lol

It’s dropped to where it was on Thursday. We’ve had 4 bigger drops in the last month and it’s still up compared to where it was a month ago.

If bitcoin/crypto is anything to go off of, that’s down 10% +. Come Monday the market will probably be a sea of red

Yea! That’s the way Republicans and Trump support the economy!

I wonder if we outsiders have to rebuild the American economy with foreign aid and a new Marshall plan in 2029…

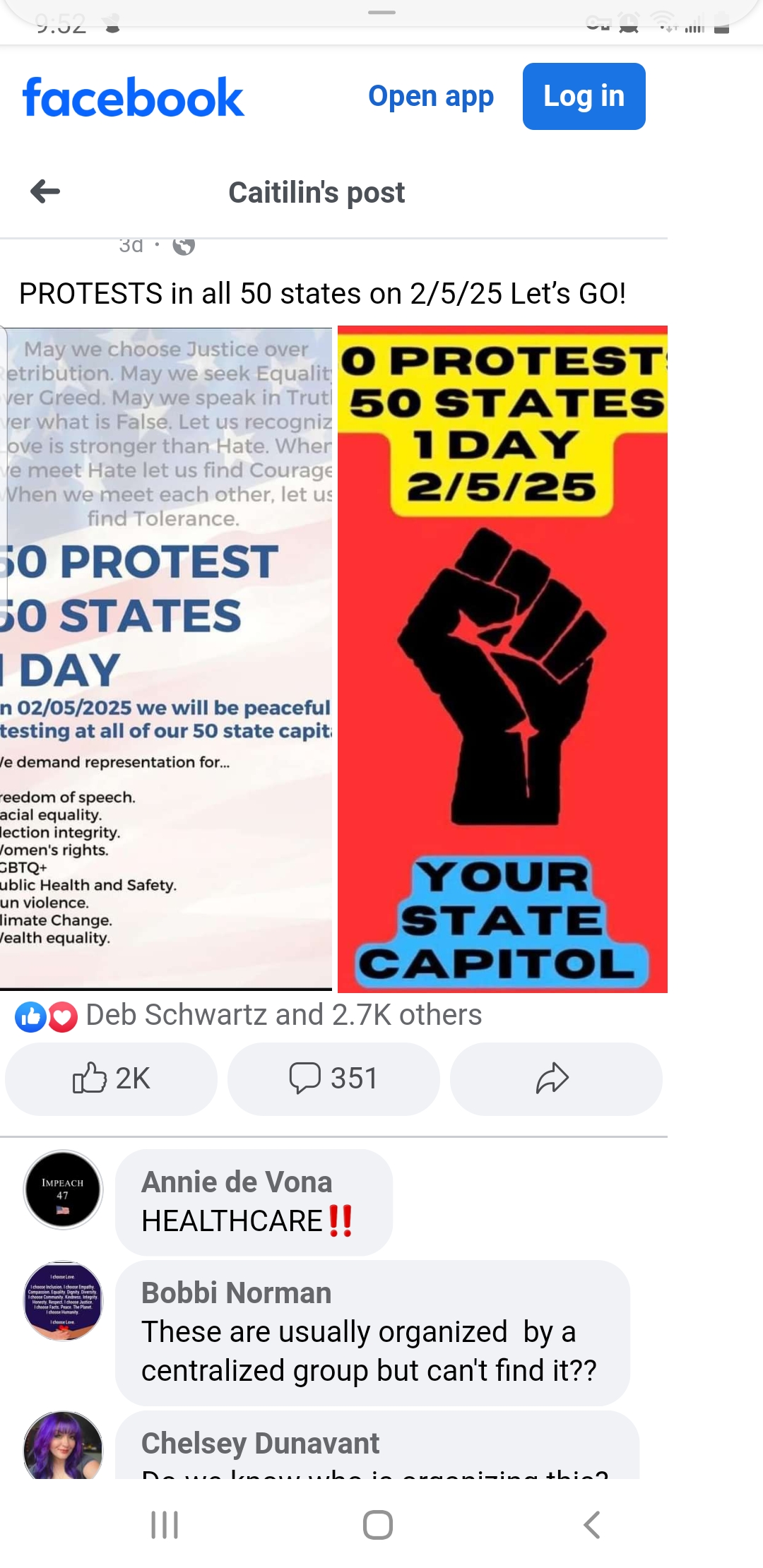

https://m.facebook.com/story.php?story_fbid=2069436850145993

50 States, 50 Protests, 1day

Feb 5 @ your downtown.

On Facebook…really?!!

it’s also on not Facebook

Bro do you think a protest is going to happen by posting it on lemmy

You’re 100% correct. Do i have to be happy about it? 💩

That’s where the sleeping sheep are at so yeah unfortunately.

Looks like the link was taken down…

It opened for me.

Is this owning the libs, or does that come with the biggest economic crash in our lives for a third time?

‘Significant losses’ being 30 points?

Yeah these people know jack shit about market variations.

The listed indices dropped an amount within the standard range that they regularly fluctuate. The dow is still up from where it was on january 1st. The same can be said for nasdaq and the s&p. Stocks are continuing to trend upward unabated, but they do wiggle as they do so.

Don’t ever trust the news when they say the market “plummets.” They use that term incredibly misleadingly. The lines on the charts wiggle constantly. When something bad happens some hack news sites will find a minor downward wiggle near the same time and they’ll claim causation and pretend that something significant happened to the markets, to drive clicks to their website.

The fact that most of the comments are taking the headline at face value is not a good sign.

plummets

The post was about the futures which are down a whopping 1.6%

So yeah, market might open at the same price it did last week.

The article even mentions specifically the Dow Jones and S&P 500. Both of which are up this week by amounts that completely offset those future losses. I honestly have no clue what the article is talking about, it doesn’t seem to conform with trivial-to-search reality. We are just where we were last week, a place that is massively up over any notable time period before.

I can’t believe it dropped 20% over… ooops I had the chart upside down my mistake