We “print” money all the time. It’s called “cryptocurrency”.

I mean…

We could just… Eat. The. Rich.

The US has such a huge pool of people using the dollar that when they do seigniorage they’re essentially taxing the world instead of only their citizens. It’s kind of obscene and why the imperialists are very hostile to BRICs.

She’s not totally wrong

If we gave every American 1 billion dollars the current billionaires would lose massive amounts of power and it would help fix wealth inequality.

It would do nothing to wealth inequality. The assets the current billionaires own would just become valued at a trillion dollars, or even a quadrillion depending on how badly devalued the dollar became.

If they had their money scrooge mcduck style. But the assets they own will explode in value almost proportionally to the value of the dollar

Oh yeah they would also need to be forcibly stripped of their assets

I thought that went without saying

Hah, well I’ll go to this strip club.

That wouldn’t work because the bilionaires don’t have money, they have assets, AKA capital.

Do that and get ready for 100,000 dollars for a dozen eggs cause the market will charge what it knows the customer can pay.

That’s the point.

The poorer groups will pay the same amount of their wealth proportionally for things, but the proportional wealth of the rich will be dimished.

Price of gold goes Brrrrrrrrrrrrrrrtrtrtttrtrtttrrtrrtrtrttrr

this could be one of those bell curve memes where the low end and high end are the moron/jedi guys saying “just print more money” and the middle of curve has a freshman Econ student trying to explain macroeconomics.

Very good observation. On the high end of that bell curve, there’s Modern Monetary Theory (MMT): https://en.wikipedia.org/wiki/Modern_monetary_theory

I came here to say this. I thought humans made the rules!

The world is run by middle-of-the-curve people.

As someone two standard deviations above the mean height, the tyranny of the average is real

Yeah but I hella refuse to see Yellen as a Jedi.

She’s like a prequel Jedi councilor

😂

Yeah it’s not as simple as just printing more money and not changing anything else, but she’s right

Yeah, exactly what I was thinking. Like, it isn’t quite as simple as “print $1m for everyone and they can all go out and buy Ferraris.” But, there are plenty of situations where the government can just print the money and it won’t cause inflation or any other harmful effects.

There’s a line from (I think) a Tyler Perry movie that goes “The only thing reparations will do is make Cadillac the best selling car in the country.”

To be fair, Economics is half imagination and magic. It’s why something like bitcoin could even become a thing.

One of the main things I learned during my economics degree is that money is fake.

To quote Brian Brushwood, “It’s just pieces of paper that we believe in.”

Was not expecting to see Street-Fighter’s-Guile-as-a-magician quoted in this comment section… PR at all really. He’s come a long way since Scam School, I guess.

The Modern Rogue was fun while it lasted.

Money is made up, but it’s definitely real. Magic is made up and fake. If it actually exists and does something, it’s real. You can bring something from non-existence and make it real. It has no intrinsic value.

A bit subjective depending on the circumstances though right? Say a man has a horse that you want. Well, today, there probably exists a monetary figure that the man would accept to sell you his horse, even if it’s absurdly high. But let’s say something cataclysmic happens and humanity is blown back to the dark ages. If there is no society available for the man to use the money, then it really doesn’t matter how much you offer him because at that point money isn’t real. You could offer to trade good or services, but not money. You might as well be offering leaves from the ground.

That’s what the guy said. Money isn’t “intrinsically” real - it doesn’t have something in-and-of itself. It’s extrinsically real - it represents something in the society we live in, a system of arbitrage and barterage that we use to represent an amount of work (Poorly, and with little benefit to a large number of people).

So no - if the extrinsic reality changes, then the barter or arbitrage currency will change - bottle caps, for instance, take over. But for a large society to function, a commonly accepted means of representing “value” has to be agreed upon. I can’t just say, “Well, I’ve got the worth of x hours worth of time spent on projects to provide”, instead I’ll say “I’ve got x pounds to provide”.

Originally, this was made more explicit, and it still exists on UK currency: “I promise to pay the bearer…” At that point, the notes had a (Bank-enfornced) intrinsic value. The words meant a promise to provide the currencies face-value in Gold. Now, we’ve done away with gold-backed currency, and the raw value is arbitrary, it has no intrinsic value but that set by extrinsic realities.

Money is an intersubjective reality, like nations, religions, and ghosts.

Two for three.

Definitely a fun philosophical and semantic thought experiment!

Money is fancy IOUs, that people mostly believe will be repaid.

Ehhh, not sure I’d go that far. Money, no matter what backs it, is just what people value it as. Just that when backed by real goods, e.g. gold, that it gives people a better reason to value it because the goods are worth something.

Mostly saying, money backed by a good have at least the value of the good itself. Which I would say makes money not fake.

When it’s backed by belief, then it’s fake.

But if it’s not backed by belief, it doesn’t work.

The value of those “real goods” is typically just as fake as the value of fiat currencies anyways. Trying to use things with actual usefulness as money has its own issues too.

Modern money is backed by the economic power of the state issuing it, so its workers, infrastructure, education, soft and hard power. Those are definitely real things with real value.

But then said good only has as much value as we put on it. There’s a tacit acceptance of what a group of people decided that good is worth. Its value is as real as we collectively decide it is; it’s a construct

Yes, but things like gold have actual uses which give them at least some actual value. Fiat currency is backed 100% by belief.

Gold as a currency only has as much value as people assign to it. It’s really no different than a fiat currency.

To be fair i was being hyperbolic. Money has the power we give it. And we gave it too much.

We print money through increasing interest rates, increasing divide between rich and poor requiring the working class to take out loan after loan after loan.

Some may say interest is the cost of borrowing money, but it is money value that comes out of nothing, it’s made out of thin air and reduces the value of our dollar.

And I suspect you might even suggest the only real aspect of economics boils down to supply vs demand regardless of what the thing in supply or demand is?

Definitely not. The rules behind supply and demand hinge on some extremely flimsy assumptions, namely:

- that people always act in their own best interest (they fucking don’t)

- that people can actually choose not to buy the product

For things like food, housing, medicine, etc. People don’t get the luxury of voting with their wallets, and this is why the free market cannot allocate resources effectively.

Just because I went to school for economics does not mean I am a free market capitalist. I’m definitely not.

Ah ok, I see the flaw in my thinking.

Things that are always in demand don’t drive a price solely based on supply, and since people don’t act in their own best interest the actual demand of something can’t be a useful way to determine the value of a thing.

So that sort of says to me that with a truly free market economy, it would be just as impossible to model future prices because of the inherent unpredictability of humans.

I’m proud to have properly digested how inflation works. But I still don’t understand it.

Inflation can be seen through the lens of lessening scarcity but for money.

Dave Ramsey is a Jesus freak but he did have some fun truisms, one of which is if you want to know where value comes from, try taking dollar bills and bottled water into an area devastated by a hurricane and see which one has more value.

Or there’s principles to economics that we just don’t understand yet. It’s gotten a lot more scientific since the 1970’s.

Printing more money and using it for public works or giving it directly to the poor could be a valid form of wealth redistribution that doesn’t require collecting taxes. The problem of course is capital, it’s immune to this kind of inflation, though rich people who have their wealth in debt would be hurt.

though rich people who have their wealth in debt would be hurt

Aren’t the big loans interest rates tied to inflation though?

Directly. Yes.

They are, but the rate you’re offered in the first place includes the loss to inflation. Capitalists aren’t going to offer a losing deal.

I don’t understand. What part of capital is exactly the problem?

My point was that the wealthiest people have most of their wealth in assets that are protected from inflation.

ahh right, maybe we should start trading in gold bars again

The funny irony is that because money is mostly made up bullshit anyway, we kinda could just decide to print more money and keep its value. Granted, it would take the unanimous agreement of basically everyone on this silly little planet, so the chances of this ever occurring are effectively absolute zero, but still, there is no actual rule that says we cant except for the ones we ourselves created

Currency divides the value of an economy. It can only represent that total value.

… but printing more would fix problems if all the new stuff went to normal people. It would give them a larger share of their economy’s total value, at the expense of billionaires. The usual trouble is that those rich fucks also get all the new money, doubling down on how they have all of the fucking money.

there is not an item of currency attached to every asset on earth…There is vastly more real asset value than there is currency.

Modern currency is liquid float to help facilitate transactions among items having real value.

Currency itself has only one fundamental value - it’s the only thing that can be used to settle taxes. This gives it a lot of exchange value - people will accept it in exchange for real value because they know there are always people needing to pay taxes, including themselves.

Governments accepted crops. Long after the invention of currency, governments still took their cut in wheat. What kind of money is a peasant going to have? All the king’s horses eat grain. This obsession with tax is a weirdly libertarian lens on a history that’s mostly anthropology.

Fungibility is the fundamental value of currency. Gift economies and informal debt only work if you see the same people on the regular. Anywhere too populous or chaotic requires a medium of exchange - some stand-in for that liquid value. And since it’s a pain in the ass to assess variabile quality, all pressure encourages commodification, and only caring about quantity.

Currency is almost inevitable from these pressures. Even functional goods like “knife money” became symbolic coins. If the point is saying, here is a knife, not necessarily a knife we both agree has suitable innate worth, then the idea of a knife is sufficient.

I mean how would taxes explain the rai stones from Yap? There’s these giant cartoon wheels that change hands without moving. People just agree, sure, that one belongs to Seema now.

Governments accepted crops. Long after the invention of currency, governments still took their cut in wheat. What kind of money is a peasant going to have? All the king’s horses eat grain. This obsession with tax is a weirdly libertarian lens on a history that’s mostly anthropology.

States are the reason everyone uses currency. States are fundamentally an army that wields its power to pay itself, and currency is a huge force multiplier for projecting power (and therefore paying itself).

The problem with crops is that they’re hard to transport, so if you and your army try to go conquer some other land, and if the army still insists on being paid upfront (it does), then you have to haul the food, using people/animals that eat some of the food they’re hauling. Now you’re facing sharp logistical limitations analogous to the ‘tyranny of the rocket’ equation, where carrying food requires more food to feed the mules, and carrying that extra mule food requires more mules which requires more mule food.

Currency solves that whole issue. The state forces the farmers to pay tax via currency, and so the farmers need to sell their crops for currency that they can pay tax with, and so now the soldiers can buy food from the farmers with the currency the state pays them. Carrying currency along with the army during a march is a relatively simple problem.

And sure, farmers could trade with currency even if the state didn’t exist, but ultimately farmers don’t actually want to trade with others - they want to be self-sufficient (within their local community), and what few trades they do actually require (e.g. buying salt, if they live inland), can still be done with crops. And do note that salt is incredibly value-dense.

Also, currency is mostly useless for farmers - what they’d mostly want to buy is food, during a famine. But if there’s a famine, everyone is hoarding food instead of selling it. So the currency is useless to buy food. Which means other farmers would be even less willing to sell the food they’re hoarding. It’s like the opposite of “don’t look down”.

I’m not arguing in favour of libertarianism, it’s nonsense. I’m pointing out some basic tenets of credit money. In whatever form currency is, it’s always tied to state power over law and taxes. The rai stones are an OK example of it.

https://neweconomicperspectives.org/modern-monetary-theory-primer.html

The rai stones are an OK example of it.

How.

I think the problem isn’t that there is a lack of money which could be solved by printing more, but that there is a lack of money because like 6 guys have stolen most of it and piled it up under their mattresses with no intention of actually using it at any point.

Prices should be set by the king tho, the only acceptable rate of inflation is zero.

So here is how it works (in the USA):

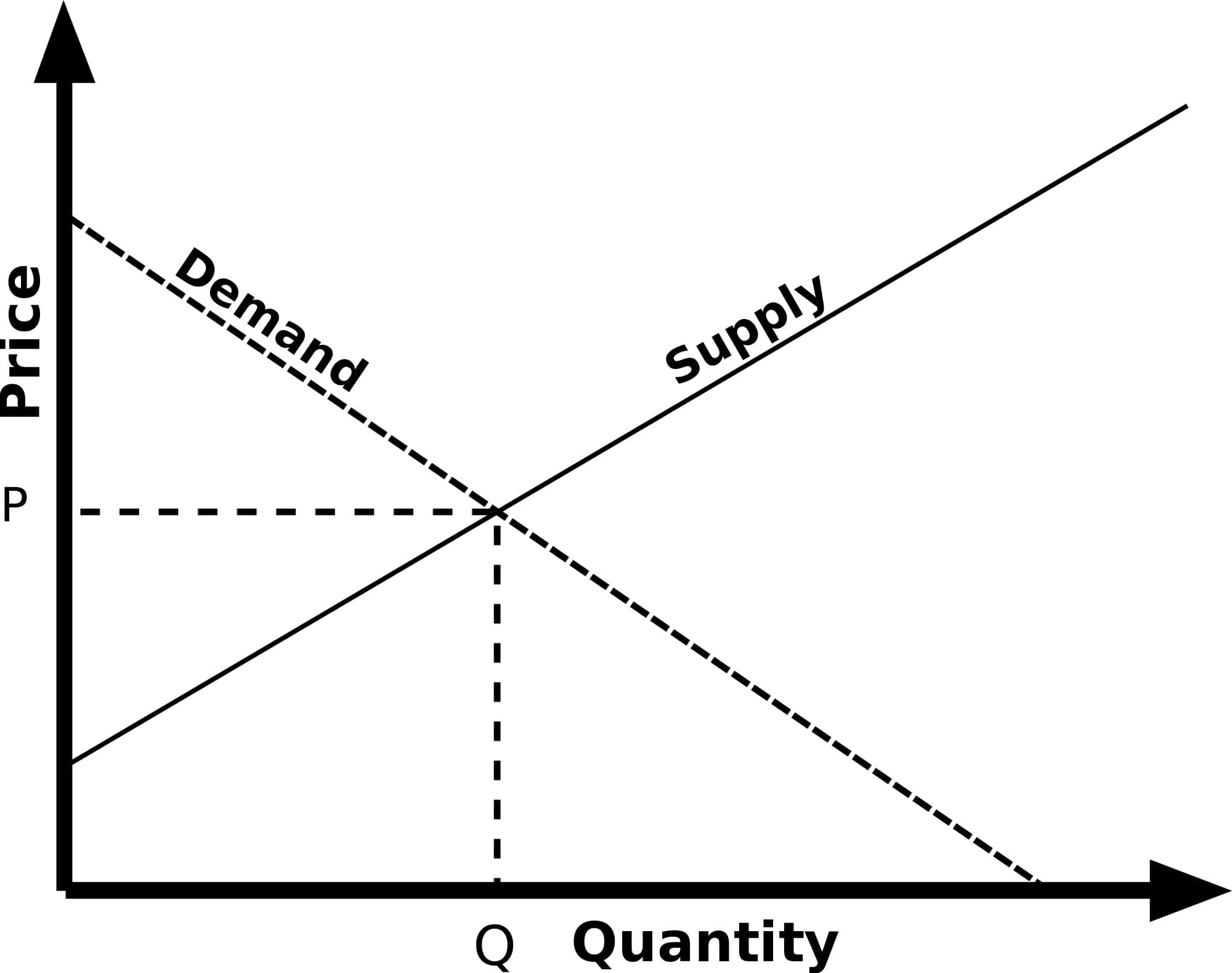

Prices of goods on a market are set by Supply:Demand Equilibrium

If a business knows they can charge more for a good or service and still sell enough to get more profit than selling them all quickly and cheaply, then they have to calculate what to sell at to optimize profits.

You can chart out the supply and the demand as a function of price with inverse correlation at varying strengths, *implying that supply will change to meet market demand so long as enough capable workforce exists to accomplish it.

Now apply this concept to Money.

If Money is plentiful and people are more willing to spend money on goods and services, then the providers of those goods and services will raise the prices to maximize the gains. In this example the regulatory bodies might use Bonds to reclaim and retire money and/or use a variety of techniques targeting loan interest rates in various ways to limit the *creation of money.

If Money is Scarce, then the prices will lower until they reach a threshold at which A) it cannot be produced for cheaper or B) somebody somewhere needs it and therefor will pay the price no matter how comparatively steep. Since these two scenarios are generally quite bad in the context of unnecessary human suffering, unprofitable goods and service industries generally receive subsidies so that regulatory bodies can keep a steady calculated amount of necessary supplies available to citizens far into the future, examples give: food, medicine, hygiene, or housing.

This also has an effect on exchange rates for trade partners. You can set a price on money. If your money is more valuable than another country’s money as a result of their willingness to purchase that money as an investment, then it makes sense to trade and buy up their cheap goods. The USA’s financial system is built around this concept of lending to struggling economies and providing data-heavy telecommunications services, built on the back of their decades of leading the pack for telecommunications technology and their leadership roles in many trade organizations including World Bank headquartered in Washington DC. Basically, the value of USD is dependent on investors in the EU and China owning US Treasury Bonds.

So it becomes obvious to most of us that creation of money can oftentimes be beneficial, but it also devalues savings and bonds, so it’s often thought a delicate balance is needed to maintain value.

-

*implying - it’s not always true that supply reflects demand in the same way that demand relies on supply, many modern economic theories revolve around the idea that Supply has much more power and therefor regulatory actions which focus on supply are more effective fiscal policies.

-

*creation of money - Loans create money. If you lend 100 dollars at 5% interest then you get back 105 dollars. While the debt is yet to be repaid, that 5 dollars exists. Debts can be traded as well. At first it doesn’t seem like it would add up to much, but in fact Bonds act as Debts and also large Loans are very very very common for the USA, and this all sort of stacks year after year until it’s reached the current point where the majority of USD is non-M1 M2 which is to say money that doesn’t physically exist: digital money and promissory notes.

Theres a lot more but I can’t be asked to teach economics.

You think this girl would understand anything longer than 2 sentences?

I think I lose most people around the graph.

Might be easier to just show the really slow ones a clip of the black and white footage of Germans setting wheelbarrows of their own worthless money on fire after the war.

Is this why Trump wants to annex Canada? He wants their freely made money?

-

It’s not particularly difficult to fix the economy.

Make a law. This law will require the head of the IRS go to the richest person in the country, and give them the option of writing a check large enough that they are knocked out of the top 1%, or playing a round of Russian Roulette.

Repeat every month, and the problems of wealth disparity will be solved in about a year.

Then it just becomes a game of “how well can you hide your money?”

That’s exactly the point.

It is much harder to “hide” wealth in the form of the highly regulated financial assets that are creating the wealth disparity problems. It is much easier to “hide” wealth in largely unregulated tangible assets, like yachts, private jets, and other things that workers produce. When they buy that jet, they pay the salary of an airplane builder. When they buy that yacht, they pay the salary of a shipbuilder.

The problem isn’t solved by taking away their riches. The problem is solved when those riches are spent. If they don’t want to do the spending, the government is perfectly capable of spending it for them.

Usually those rich guys don’t have that money sitting around - it is invested somewhere. It also often only exists as shares - that are some kind of imaginary money that doesn’t really exists.

They can’t spent that money without destroying what gives its value.

You are describing “securities”. Financial assets. Those financial assets (when held by the ultra-rich) are the problem. Those financial assets are transferring real wealth from the general economy to the people holding them.

I addressed financial assets.

Now, the nice thing about shares is that they don’t have to be held by any particular person. The value of those shares doesn’t change when they are transferred to someone else.

We could, if we wanted to, establish a tax on registered securities. We could have the SEC automatically transfer 2% of the shares in Elon’s portfolio from his ownership directly to the IRS. We could do that every year if we wanted to.

IRS liquidators could then sell off those shares, slowly over time, so that their sold shares are never more than 1% of the total traded volume.

Humans do make the rules, unfortunately only some of them get the chance to so they made the rules favor themselves.

The problem here is that a government does not in fact have the ability to decide how much their currency is valued, they can only indirectly influence it. When they try to pretend like it’s just a “rule” they can set like “here is the mandated exchange rate, we’ll put you in jail if you make trades at any other price” is when things get real stupid.

India made a run at wealth hoarding by issuing a new currency. They declared it was worth something like 5 old currency and you had to personally turn in old money to get new money. You couldn’t just digital it.

I have no clue how well that did or didn’t work but they haven’t imploded yet. So there’s a lot more play in this money thing than the finance industry would like us to believe.

They declared it was worth something like 5 old currency and you had to personally turn in old money to get new money

Then it’s not just backed by their declaration