This is exactly what mega-corporations want. If we save money, they don’t get it.

The powerful rich are always pushing for the closest thing to slavery they can get away with.

On the other hand, some of them just refuse to do any overtime or aim for promotion. It won’t get them any closer to their goals so why bother. It’s quiet quitting by default.

I’ve never understood “quiet quitting” as a term. When did just doing your job become something that needs a term? “Working adequately” seems more apt, but I can’t imagine the context that would be worthy of discussion outside an employee review.

They used to say “give it 110%”

In that context, here is a little decades old joke about that.

If: A B C D E F G H I J K L M N O P Q R S T U V W X Y Z is represented as:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26.

Then:

H-A-R-D-W-O-R-K

8+1+18+4+23+15+18+11 = 98%

and

K-N-O-W-L-E-D-G-E

11+14+15+23+12+5+4+7+5 = 96%

But,

A-T-T-I-T-U-D-E

1+20+20+9+20+21+4+5 = 100%

And,

B-U-L-L- S-H-I-T

2+21+12+12+19+8+9+20 = 103%

AND, look how far ass kissing will take you.

A-S-S-K-I-S-S-I-N-G

1+19+19+11+9+19+19+9+14+7 = 118%

So, one can conclude with mathematical certainty that while Hard work and Knowledge will get you close, and Attitude will get you there, it’s the bullshit and Ass kissing that will put you over the top!

Lolbruh. Yeah, I made the poor decision of getting a phd. At least it was in the hard sciences, so I learned some transferable skills. I BSd my way onto a high-paying career track. You gotta BS.

It’s about creating a negative connotation with doing your job, so you’ll either feel guilty about not doing more than your job, or feel anger at those who do more than you.

You know, keeping the plebes angry at each other so they don’t think too hard about the wealthy.

I can give you a real answer if you’re sincere, but this tends to disappear into downvote oblivion.

Quiet quitting is a sudden and noticeable shift, not in reduced performance, but engagement and morale. Increased negativity, pessimism, criticism, etc. It adversely affects team morale, often resulting in reduced performance of others. It’s more effective than you may think.

A good manager would address this with questions to better understand the sudden change in job satisfaction, and meet those concerns with change. Most seem to be complaining that they don’t have a reason to fire the team member, which is why you always read about “continuing to meet performance expectations.” If a manager told me the latter, I’d address it as a failure of their leadership skills.

I started quiet quitting after it came to light that the new hires with zero experience were being paid more than I was, someone who had been there for over a year, and already had 5 years of experience. I no longer give a shit about the company, because they made it clear they don’t give a shit about my contribution. If you want people to put in extra effort, you have to give them extra money. Once you cheat an employee, they’re not gonna get over it because of a pizza party. fucking pay them.

Again, it’s not about effort or results, but morale. Unequal pay is an absolutely justifiable reason for low morale.

You’re either lying or you’re simply misimformed. You didn’t mention staying late and doing extra work, which is what most people have meant when using that term to denigrate workers that do their job well but leave immediately after work is completed.

Ah, that makes sense. I’m in the military, and we have a similar thing for people who are either due to transfer or retire in the next couple months: FIIGMO. It means “Fuck it, I’ve got my orders.” (For clarification, orders in this context are travel/Primary Change of Station/Retirement Orders, a written and signed document saying they’ll be leaving)

It seems like a weirdly deliberate term for something that has been around forever and typically just attributed to low morale. It makes it seem like a person unhappy at work but just doing their job is somehow sticking it to their boss/company. I’ve dealt with a lot of people like that, both as a peer and a supervisor, and it was never them doing anything intentionally, just being unhappy (and most of the time it had nothing to do with the pay or conditions, just not being suited to the job or general attitude toward life). They could often be a blight on morale, though, so I see how it could be frustrating for supervisors (and peers, they made work miserable for everyone).

Quiet quitting is just middle management’s manipulative language for people doing their jobs adequately but then not putting in a bunch of unpaid extra effort. When there is no incentive to go above and beyond, why should anyone? It is the job of management to create those incentives, but if they are unwilling to pay for that, complaining about people’s work ethic to try to guilt them into doing unpaid work is their next strategy. It isn’t very effective.

You’d think actual pay would be the next step after they realized pizza parties weren’t cutting it anymore

Nope, the new strategy is to just complain “no one wants the deal I’m offering”

Fuck overtime. Forty hours a week is plenty.

Once they have everything, then what happens next? If there is nobody to buy things

Why we are not having kids or even getting married can’t collect my debit when I am dead and have nothing. Just go full nihilist

I’m saving up for the American Dream 2.0™️: Moving to another country

It’s not just America though.

Where I’m from:

UK average income before tax) £34,963 - £27,911 after tax (assuming NO student loan and NO pension) (for context: a band 3 nurse with 3 years experience makes £24,336 before tax or £20,631.51 after with no pension)

England average house price: £375,131

Approx ratio after tax: 13:1

Minimum deposit: 5% - £18,756.55

Tax: 0% on first time buyers

Fees: about £1,000 - £5,000

Total cost to get going: Approx £21,750 - nearly a years wage.

Now let’s look where I live: Spain!

Turns out Spain really is a load of countries wearing a hat so getting unified stats is not easy. Let’s try Barcelona:

Average income before tax: €33,837 - €25,470 after tax

Average house price: €376,399

Approx ratio after tax: 15:1

Minimum deposit: 10% - €37,639.90

Purchase tax: 10% - €37,639.90 (plus 1.5% for new builds)

Fees: 2 - 5% - 7,527.98 - 18,819.95

Total cost to get going: €82,807.78 - €94,099.75

Turns out treating housing as a market to speculate on might just be the problem all along.

Yeah, I hate this American-centric idea of “Oh, only my country is experiencing this totally unique problem, I’ll just go somewhere else.”

As if late-stage global capitalism would somehow be a problem that is unique to a single country.

The fediverse is a lot more multinational than That Other Site, and I’m seeing the same sort of articles from all over the place.

Yep.

The theatre is closed. There is no place else to go.

And by “theatre” we mean the theatre of conflict not the cinema.

It is time to stand and fight.

To be fair, the UK is essentially aiming to be America 2.0

Many countries are trending more expensive (Belgium went up 30% house price in 4 years) but the UK is on another level of the wealthy literally owning all property and purposely leaving tens of thousands of houses empty just to spite the working class.

I knew someone would say this, which is why I also used Spain where the houses are as expensive, the pay is worse, and the tax is higher!

It doesn’t matter where you go in the West, the dream of liberalism is dead

Unfortunately not much better elsewhere, if at all. What would make me move is the idiotic healthcare system.

“Consumers demoralized by capitalism…” …paywall…

Let’s go a little hollow, as a treat 💀

If the American Dream were realistic, we wouldn’t be calling it a dream…

You have to be asleep to believe it --George carlin… I probably dodnt get it right

Nah, that was pretty much word for word what he said 🙂

A fantasy?

An ad.

I mean, it was real for white people. It makes sense why they’re the most pissed and confused lately

Exactly, it would just be the “American Way”.

Every time I read the phrase ‘the American Dream’ I think of the part of Fear and Loathing in Las Vegas when, after spending the whole novel trying to find the American Dream, they’re given directions, only to find the remains of a burnt-down nightclub, “a huge slab of cracked, scorched concrete in a vacant lot full of tall weeds.”

Thompson rightly concludes that the American dream is already dead by the 70s.

If you look west you can almost see the place where the wave broke and rolled back…

Thompson rightly concludes that the American dream is already dead by the 70s.

Important context for that is that the novel is a famous, and relatively early, meditation on the failures of the 1960s counterculture movement and the intense, if ultimately unfocused vision for a better future for the nation that was central to it.

Fear and Loathing should be required reading in schools. A lot of the meaning gets lost in all of the drugs, but in the midst of that haze one can find a lot true things about America.

Never read it because I assumed it was just a funny story about guys on drugs with his characteristic cool writing style, but if it had actual things to say about America, maybe I’ll read it sometime. Or watch the movie lol.

The movie actually takes all of that out unfortunately and makes it much more of a funny story about guys on drugs. I still like the movie, but the book is so much deeper and more meaningful.

I liked the book and I was surprised how close to it was the movie, the part tgat got there. And yes, they left out many things, but it’s understandable, because the movie was planned as a “funny movie”, not a “socio-economical movie”. So the book was like “drugs-capitalism-drugs-Vietnam-drugs”, tgey cut out all the “boring” parts, leaving only drugs.

The movie is cool though, but It’s just me always trying to appreciate what is shown to me, and not trying to compare with another media.It’s definitely not a bad movie or even a terrible adaptation of a book. Like you said, it just had a different goal with the same story. That’s fine.

I think of the Carlin bit… It’s the American Dream because you have to be asleep to believe in it.

“Everything is very expensive, and people can’t save money”

FTFY

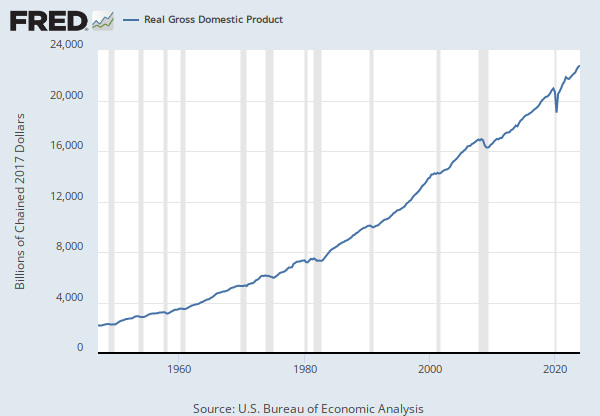

Its a curious state of affairs, because the stock market has been booming all the while.

If you have savings you’re getting enormous passive incomes. 20-30% jumps in accumulated investments annually. If you don’t have savings you’re watching prices skyrocket while salaries flat-line in the face of anti-inflation economic policy.

This does kinda raise the question “Where are equities markets getting all this extra cash from?” And the answer appears to be… its very profitable to charge people more and pay them less.

The stock market is a measure of how much wealth can be extracted from the working class.

It does not measure the health of the economy. That sometimes the market is doing well as the economy is doing well is closer to coincidence than causality.

The fact that the working class can no longer save money, and must spend every dime is great for the stock market. Next they will come for the dollars we have not spent yet. Because mortgages are no longer feasible for most people they’ll have to find new debt traps. Cars will skyrocket in price, you’ll be able to take out a loan to rent an apartment. Student debt will spiral to laughably unrepayable levels.

They’ll take every dime we have, then they’ll take every dime we’ll ever make. And when it gets to the point where there’s no more money to bleed, unless a new source of endless dollars can be found, the market will feed on itself.

If you think peacefully protesting Wall Street is going to fix that, I’ll sell you the Brooklyn bridge.

They’ve already taken every dime we’ll make, plus every dime our children and grandchildren will make… That’s what the trillions of dollars in debt is.

The stock market is a measure of how much wealth can be extracted from the working class.

I’d argue it goes beyond that. Quite a few ticker symbols on the NYSE are speculative above and beyond anticipated surplus extraction. They’re functionally auction prices on coveted luxuries.

Because mortgages are no longer feasible for most people they’ll have to find new debt traps. Cars will skyrocket in price, you’ll be able to take out a loan to rent an apartment. Student debt will spiral to laughably unrepayable levels.

These have largely come to pass. The “loan to rent” is just your deferred payment on credit card debts to cover rising rental rates.

If you think peacefully protesting Wall Street is going to fix that, I’ll sell you the Brooklyn bridge.

Sure, I can buy it. I just don’t try to cross it for fear the NYPD will arrest me.

stocks are as divorced from actual value now as cryptocurrencies. real estate too. it’s all grift all the time. have a look at the value of djt or tsla, they’re nfts.

it’s all grift all the time.

Its decades of cheap lending to people with all their consumer needs satisfied. If I can borrow at 4% and get 20% ROI, I’m going to borrow every dollar I can get my hands on.

On the flip side, you’ve got private lenders offering double-digit interest rates to the underclass. They’re lucky to get a cost of living increase year over year. So you’re asking people to borrow at 20% with the expectation of a 2-4% ROI.

have a look at the value of djt or tsla, they’re nfts.

DJT is fucking hilarious, because its pure vaporware. But TSLA does actually have factories and vehicle stock and revenue streams and such. Its mismanaged and overvalued, but there’s some amount of there there.

But who is holding Tesla? Vanguard Group, BlackRock, State Street Corp, and Geode Capital Management all have access to the Fed credit window - either directly or through proxies - and can borrow at miniscule rates. They get a positive ROI so long as Tesla appreciates at all. And the long term ROI on an electric car company looks pretty good, even if its overvalued in the short term. So buy buy buy!

Look up the Haymarket square protest.

“A harsh anti-union clampdown followed the Haymarket incident and the Great Upheaval subsided. Employers regained control of their workers and traditional workdays were restored to ten or more hours a day. There was a massive outpouring of community and business support for the police and many thousands of dollars were donated to funds for their medical care and to assist their efforts.”

bootlickin’ since time immemorial

Support for the 8 hour day also blossomed after the Haymarket incident. It lead directly to May day.

you’re right, but i’d love to see, just for once, the people clap back with fierce resistance that amounts to “FUCK YOU I WON’T DO WHAT YOU TELL ME”. fuck the waiting period of change. i just want to know that we have the power to resist without compromise.

and when i say ‘the people’, i really mean the radical progressives.

- It’s* a curious state of affairs

- it’s* very profitable

Literally nobody was confused by those grammatical mistakes, this is just a stupid grammatical rule designed to be a gotcha that grammar people can wield as proof that someone isn’t well educated.

Put the apostrophe wherever the hell you want, just write in a clear way that gives enough context that unless someone is a computer program incapable of tolerating slight grammatical mistakes they will understand fine.

This is true, I asked a new-ish employee about getting/saving for a house and she was like, “why bother? They cost to much.”

the price of homes goes up faster than anyone can save. that’s the problem.

housing prices used to rise at or below inflation. now they rise at like 3x inflation.

Even you are thinking too far ahead. I’m spending rent money every month that obviously could be saved to someday buy a house… But on top of that my rent has increased faster than my income. Every place I’ve lived. By renting, you’re guaranteeing you’re going to be priced out of affording your shelter. And most young people have to rent, to start out. The rich have us fucked at every turn…

deleted by creator

“Getting screwed by government”

That’s the primary issue. Stop deflecting from the fact. Government is and always has been a problem. Fix government spending, checks and balances, audit the fed thoroughly, and everything else will fall in line.

Stop spending on war. Problem solved.

Facts. Not just that… our government is infatuated with spending tax dollars on really stupid studies. For example quails high on cocaine.

And these amongst a long list of other wasteful spending:

Fauci’s NIAID spent $478,188 to turn monkeys transgender $6.9 million smart toilet analyzes “anal print” Feds give $300,000 to virtual reality penguin study The State Department gave $25,000 in grants to Chinese surfers Harvard spent $75,000 in federal grants to blow lizards off trees with leaf blowers

The headline reads like big retail trying to squeeze more profits. Of course people aren’t saving as much, they have to buy groceries.

No, but even for those of us with some extra money… we’re not building a savings pile for a house or anything… we’re just spending the extra on doing things and buying stuff beyond our needs.

This is how you never accumulate wealth…

Itty bitty savings will never lead to wealth either. The working class and “middle class” that remains has a low enough income to recognize this.

It depends on what you call “itty bitty” and “wealth”. Saving $1,000/month is doable for many people and will make you a millionaire by retirement age, even adjusting for inflation.

Saving $1,000/month is doable for many people

You’re not being serious, right?

Crackitalism is a serious drug Jimmy, it’s deadly serious.

And don’t call me Shirley.

Bro, what?! Who the fuck can save $1000/month with current rents and home prices? 🤣

I thought you were serious for a second! Good one.

lol. It’d actually be kinda disrespectful if it wasn’t clear you’ve never met a struggling American in your life

$1,000/mo in savings is pretty difficult for most people.

$300/mo, invested earning 8% for 40 years, does get to a million though (10% rate of return + 2% interest safe assumption.) This is as $60k/yr job, contributing 3% to a 401k with an employer match, not something that’s particularly rare.

I know prices are high and people are hurting… but there’s a lot of people who are just not really trying.

Not if you’te middle aged by the time you get a job that allows you to save.

we’re just spending the extra on doing things and buying stuff beyond our needs.

That’s one of many problems and majority of the people who fit this category like to point the finger at anything and everything else… when the problem is themselves and their spending habits.

We’re in late stage capitalism. Getting rid of the gold standard was one of the biggest mistakes in US history.

It blows my mind that the world basically runs on Monopoly money and accounting smoke and mirrors.

For a while now, I’ve had a hypothesis that money does have a real, tangible underlying asset attached to it, in the exact same way as it used to be backed by gold or oil.

The underlying asset is human capital and the value is derived from human labour.

The reason for my belief is because private banks actually create 80% of the money in circulation. They create this money when they issue loans.

How do we determine the amount of loan we can take? The amount of money we earn. We earn money either via our own labour or someone else’s. Ergo, money is created at the value human labour you own, like how we used to do so with gold and oil.

Money here acting as both an iou and as a labour token, in the same way a British Bank note was both an iou for gold and affected gold prices, we have been buried under a labour debt our great grandkids would come close to paying off. Printing of future Labour ious also depresses wages for everyone who works for their money.

Imo, its much worse than monopoly money.

Well yeah. If you trace it backwards, before fiat, what was commodity backed currency? What inherent value is there to gold and silver? Back then there was little industrial use, it was just useful as something to trade for other things.

So going back further, at it’s core, currency is just a middle man to bartering. Instead of trading the grain you labored to grow for shoes from the cobbler, when you don’t need shoes right now, you take gold/shells/beads knowing you can use them to trade for repairs to your plow from the blacksmith. Currency has always been a social construct, not inherent to the commodity.

This is actually one argument against the hoarding behavior of the ultra wealthy. It disrupts the natural economy and creates unhealthy power dynamics. The rich person can distort labor away from productive things healthy for future development of the society, say by using their vast wealth to pay a ton of farmers to build statues of the rich guy, until suddenly there’s famine because no one is growing food.

So going back further, at it’s core, currency is just a middle man to bartering. Instead of trading the grain you labored to grow for shoes from the cobbler, when you don’t need shoes right now, you take gold/shells/beads knowing you can use them to trade for repairs to your plow from the blacksmith. Currency has always been a social construct, not inherent to the commodity.

This is what David Graeber calls “The Myth of Barter” and has no basis in history or anthropology. Trade was happening for thousands of years before the first currency was invented in the 6th Century BC. There are other ways to arrange trade that don’t require currency as an exchange of value.

For example, if I were a barley farmer in ancient Mesopotamia and I wanted to get drunk before harvest, I could write an IOU for part of my barley harvest to the bar owner. Then, if he needed to buy something he could take my IOU and trade that for whatever it was. This IOU would go round and round the economy, but it also made them pretty unstable if the barley crop didn’t meet expectations.

If this is interesting to you I highly recommend the book Debt: The First 5,000 Years which goes into a lot of detail about many different economic systems that have existed.

Think the point is that alternative strategies were in play when the biggest, most overwhelming cities in the world were maybe 100k people, the world population was 1% of what it was today, and economic activity was relatively limited in what sorts of goods and services were for trade.

Currency came about because as the indirect bartering relationships became overly complex and the number of participants exploded.

Though the currency situation did set up a sort of ‘meta’ of gaming the numbers for sake of the numbers themselves, which grew out of control until breaking the gold standard. Of course it’s still out of control, but what we see is nothing compared to the instability of a gold standard currency trying to tackle current day human activity.

IIRC it had a lot more to do with exerting central control on trade. That’s why going back to their invention coins had pictures of rulers on them.

Every currency’s value is “potential to convince others to do labor for you”, that doesn’t make fiat different, it would be a chicken and egg problem otherwise.

The value of a currency is “what makes people want to accept this currency?”. The answer is taxes. You live in a state. That state requires you to pay taxes in a currency (or set of currencies). Doesn’t matter how much gold you have, if you want to keep your house in country X, you have to pay it for property taxes in a currency that that state accepts, otherwise that state’s police will revoke your ownership of the property.

States have a monopoly of violence, therefore currencies have value because it’s the only way to preserve your ownership of property via taxes.

The difference being, like in the roman times you’re referring to, the coins at least had some other kind of underlying value.

I agree that was heavily inflated and, eventually, the value of the coins became more than the value of the metals the coins ended up as after clipping etc.

However, now there isn’t even that pretence. Human labour is the underlying asset here imo.

It’s not that I dont know how money works. Its that I think about it differently. To me, it makes a lot more sense than just that we believe in it really hard, with extra steps. Its that now, the rich get to keep hold of the gold too.

A way to think about the idea is the financial crash. “Sub prime mortgages” means “fraudulent loans to people who didn’t exist” (money creation). The money created by those loans was spent a thousand times over, all due back to bigger banks who leant them money, with new loans and made with them as collateral and all packed into toxic financial instruments. When it was found out that those people didn’t exist, the money literally disappeared. Thats how “companies balance sheets just vanished.” Thats whys Governments had to print money: because the money had vanished and there was a gapping money void due to it.

There was no one to work off the value of the money that had been created and, just like if you found out thr bank didn’t have any gold (back in the gold standard days), the IOUs (money) would be worthless.

To me, it point to seeing the world as a human labour farm and the currency is human labour IOUs, in the same way cotton, sugar and steel nails and their IOUs in Virginia, the Caribbean and the North East of England respectfully were also used currency or were the equivalent of currency.

A way to think about the idea is the financial crash. “Sub prime mortgages” means “fraudulent loans to people who didn’t exist” (money creation). The money created by those loans was spent a thousand times over, all due back to bigger banks who leant them money, with new loans and made with them as collateral and all packed into toxic financial instruments. When it was found out that those people didn’t exist, the money literally disappeared. Thats how “companies balance sheets just vanished.”

Uhhh that’s not what the sub-prime mortgage crisis was. What you’re describing was extremely risky mortgages being rubber-stamped to borrowers who shouldn’t have received them, then bundled into Mortgage Backed Securities (basically a type of bond backed by, say, 500 mortgages containing a variety of risk profiles designed to balance out into a low risk but decent yield investment) and the fraud was that too many of these high risk mortgages were bundled into these securities and the risk level was misrepresented to investors, so when people defaulted on their mortgages in large numbers this caused the MBSes to rapidly devalue (which given they were treated as a way to protect capital against instability this greatly damaged many funds such as retirements and bank investments, 2 things that are heavily regulated to make safe investments because the risk is too high should they fail)

Or just go read the Wikipedia page for far more detail: https://en.wikipedia.org/wiki/Subprime_mortgage_crisis

Thanks, I’ve read it. None of what you said is wrong and none of it refuted what I said about it all either. They’re not mutually exclusive.

Plenty weren’t simply “risky loans.” That’s corporate speak. Technically true in all instances but not incriminating. After all, what loan could be riskier than one made to someone who doesn’t exist etc.?

https://www.theguardian.com/news/2022/feb/21/tax-timeline-credit-suisse-scandals

But the important part is that you’re not cross referencing that with how money is actually created and destroyed these days or, it would seem, or acknowledging the level of fraud involved on the issuing of the mortgages, bundled up into those MBSs.

Therefore, if you borrow £100 from the bank, and it credits your account with the amount, ‘new money’ has been created. It didn’t exist until it was credited to your account.

This also means as you pay off the loan, the electronic money your bank created is ‘deleted’ – it no longer exists.

https://www.bankofengland.co.uk/explainers/how-is-money-created

The BoE is the UK fed and its not going to be different in America. Both countries have the same monetary policy.

Money is created - human labour - money goes back and is destroyed.

Back to the banks, they created money when they issued those mortgages. They wouldn’t me mortgages otherwise. As a bank, in a system of fractional reserve banking, they’re as good as money. Those mortgages didn’t get parked on some balance sheet in the sky. Not trying to be patronising but to really crystallise it.

When the people couldn’t pay it off with either their own work or someone else’s, either through being dead or just not being able to pay, the money already created, already in the system, vanished. Just like if it turned out the bank of England had no gold at all, back in the gold standard days.

I’m not an expert and really a bit of a moron, but it’s nice to actually see something I “thought of” taken seriously. I’ve argued with friends that money really is just “human potential energy.” The only thing you do with money is “inspire” others to do work. I usually just get laughed at though lol

Ultimately, the question is: “What is the dollar a unit of?”. The answer is roughly “energy” in the physical sense, or effort/labor in more human language.

What I think is interesting is that then, the social and physical definitions of the word “power” collapse into the same thing; one with more “power” is able to expend more “energy”, the labor of others, in a shorter time.

If you’re really interested in the topic, read the book “Energy and Civilization: A History” by Vaclav Smil, published in 2017. It covers the efficiencies of tool use and how innovations in technologies that caused increased labor efficiency have catalyzed societal changes and revolutions, even going so far as to discuss GDP in units of Joules.

Sorry to hear that. Personally, and I might be a millions miles off here, i find its usually only stockbros who react that way. You know, the kind who get their financial advice from wallstreetbets.

I know that it’s a radical idea to lots of people and I may end up being ultimately wrong but I think its a position I can a least logical argue. I think better than the “power of friendship” or infinite debt loop of debt that isn’t owed to anyone, nor does it ever have to be repaid (making it, by definition, not debt).

For me though, money would be an IOU for human labour, exactly like the old British pound was a literal IOU for gold. Its not far from what you said at all, tbf, but I think its more sound wording. Kind of the technical long form of that which could exist in our society.

I find people who make this “argument” very silly. The gold standard is unsustainable. The amount of cash in circulation will always outstrip the amount of gold in whatever vault it been tied to. Fiat money is always an economic inevitability for a growing state.

The amount of cash in circulation will always outstrip the amount of gold in whatever vault it been tied to.

That’s… the entire fucking point. They printed away our futures, now we suffer.

They printed away our futures

If the amount of potatoes we produce every year goes up and the amount of currency we print every year goes up but the amount of gold we have in our vault stays fixed, the real economy doesn’t care. You’re trading dollars for potatoes and potatoes for dollars. The gold is irrelevant.

But if potatoes go up and currency stays fixed, you have too few dollars chasing too many goods. This deflates the cost of the potato and discourages the next crop. Smaller crops mean food shortages. And food shortages impact social stability. So now you’ve got riots from a food shortage that was created entirely because you didn’t print enough currency to buy up all the potatoes.

Riots from a food shortage because potatoes became too cheap? Funny speculative statement. What about riots because everything is too expensive?

Riots from a food shortage because potatoes became too cheap?

Riots because people stop growing potatoes and start growing bitcoins, in order to chase the highest possible ROI.

What about riots because everything is too expensive?

You’re looking at debt without looking at revenues.

Far worse to owe $10 when you make $10/year than $10M when you make $10M/year. Particularly when I the value of the asset I’ve purchased is rising faster than the debt-rate. Owning a $100M house on a $10M note is an incredibly deal. Public Debt in service of GDP growth is simply investment. And the ROI on that debt has been incredibly good.

That’s only true when you are dealing with the infinite growth of capitalism. Nations and empires have used the gold standard for thousands of years. It only became “impossible” when we tried to inflate the value of economies into the stratosphere to enrich the aristocrats of society.

Nations and empires have used the gold standard for thousands of years.

Crack open David Graeber’s “Debt: The First 5000 Years”. He’s an anthropologist who spent his career investigating this theory, and he found it wanting. Hardly the first, but probably a more fun read than Thomas Piketty or Milton Friedman or Adam Smith. Nations and empires didn’t use gold specie until fairly recently in human history. Most of human civilization revolved around different types of credit and debt, typically enumerated in volume of agricultural produce.

Wheat/corn/rice, fish, olive oil, and salt were the most common standards of exchange. Gold was ornamental, but far too little of it existed to circulate as common currency or even reserve currency. It wasn’t until the colonial era and the mass exploitation of Africa, East Asia, and the Americas that European Banks had a large enough surplus gold reserve to treat it as coinage.

So you’re talking at best hundreds of years, and even then only within the handful of European powers capable of plundering the gold reserves of foreign nations on a global scale. And even that only got these countries from the 15th to the 18th century before the system started breaking down.

Ok. Fair. Let me correct myself: money was based on material goods and not rich peoples feefees about the economy.

Definitely closer to the market. Although one major form of historical debt is taxation, and that’s traditionally been subject to how rich people feel about the economy.

The government runs out of money… so it drops the gold standard to “to invigorate the economy”… by taking away value from those that hold cash… which is always the lower class. Higher classes hold assets that dont inflate away.

The problem with this argument is that it neglects the consequence of specie entering and existing the market.

The California and Alaska Gold Rushes did more to devalue the money supply than anything Nixon tried. The Spanish economy of the 1700s imploded in the face of the gold glut it imported from the Incas and Aztecs.

A gold standard doesn’t stabilize the money supply. It simply deflects the question of what that money supply should be onto the private commodity market for gold. But volatility in the gold supply does happen, particularly during times of economic turmoil. And a pegged currency encourages private arbitrage, which increases the frequency of these sharp shifts in gold availability.

And that’s not even getting into what happens when you’ve got a private speculative asset independent of gold - maybe we call it real estate or company stock or cryptocurrency - that siphons off investment dollars one minute and floods the market with currency/commodity-hungry panic sellers the next. Even if you’ve got a stable gold/currency ratio, these aren’t the only two variables in your economic model.

No amount of gold changes the number of potatoes the Irish have to eat.

Holding cash makes it sound like it only impacts those who have cash savings, but it takes value away from the work you do as you get paid in cash and those wages never keep up to inflation from the printing machine. So they “invigorate” the economy by devaluing your work.

laughs in Calvin Coolidge

Yes. YES! Let the Austrian Economics flow through you! Speculation is a consequence of federal monetary policy and commodity inflation. I can’t possibly have anything to do with private credit or free market auction rates.

Oh. Oh shit it hurts that reading this made me self-aware of this behavior. It’s one thing to be in this mindset and not be aware of it and it’s another to have it written out in front of you. 🤢

My retirement plan is a heroine overdose. I’ll try to do better than that, but I’m not expecting much.

Ya know, I’ve been saving better than most my age. 401k, savings account, emergency fund, investments, crypto, etc. and I keep being reminded that no matter how much I save, I’ll still never achieve the American dream without help.

I’m in a similar boat, minus crypto. If anything it’s made me realize how big that chasm has become.

What the fuck is this American dream anyway?

Economists: “WONTFIX: Working as designed.”

it actually kinda pisses me off. we have been dropping the ball as consumers for a long time. if people would just stop buying all this bullshit, the market might reconsider.

🙋♂️ That’d be me. Keep moving the goalposts society. I’m over it. I’ll wait for my mom to die to get her house. Idgaf anymore. Don’t need a house.

deleted by creator

Removed by mod

Lots of news articles this week using a lot of words to say “Americans don’t have savings”

“Prices are going up but wages aren’t. What have millennials done to cause this?”

Removed by mod

And whose fault is that??? HMMMMM points at you

Thanks, Skeletor!

Removed by mod

There are dozens of us. Dozens!

Now there’s a baker’s dozen!

Millennial here.

I wish I didn’t.

thoughts (no self harm talk, just sadness!)

My society clearly hates me and doesn’t want me to exist, my parents bought the modern austerity riddled American dream hook line and sinker and so they believed they shouldn’t help me too much after I became an adult and basically they severed that deep link between parent and child for… some shitty neoliberal ideologies that are empty as fuck?

I am a millenial and I exist, I don’t want to, even though I was given a lot of privilege when I was younger I am ADHD as fuck and life is honestly genuinely miserable. The world wasn’t designed for my brain, it was designed to shunt someone with my brain into jail or a death spiral of some kind of addiction (you ever looked up the percentage of prisoners in US prisons that likely have ADHD? It is shocking).

It would be one thing if things were getting better for ADHD people, but they are quickly accelerating towards being worse in every aspect, random ADHD med shortages because the FDA wants us to die, more and more executive function required for basic tasks (more paperwork, more scheduling, more consequences for not following rigid schedules perfectly), less and less energy and free time available left over after work, less and less tolerance for simple mistakes at work, more complex and brittle steps to get healthcare help that involve a million carefully designed give-up points custom designed to coax an ADHD person into never utilizing their healthcare because they can never get through the hoops to do it. The job application process of sending out resumes to online job after online job alone is catastrophic for my ADHD.

I am not going to hurt myself, or by extension others around me, after all that is precisely what is making me sad in the first place. I have lost that flame inside me because I know I won’t be able to live a fulfilling life where I am genuinely happy in a way that I don’t always go to sleep at night wishing I could disappear painlessly and be forgotten by all…. unless I win the lottery either literally or get the rare job that doesn’t treat me like shit. (Then I am happy and am surrounded by a bunch of dying people like me that I have to try to ignore…?).

It is hard because therapists are usually older adults and they just can’t understand this depression as a rational response from an entire chunk of a generation rather than an individual pathology. Focus on the positives! they say….and I think… I will eventually die of old age or health problems (hey can’t afford the doctor or dentist so that will speed it up :P ) and wont have to force myself to survive in a society with rules designed to put me in a constant state of suffering while constantly coding my desperate struggle to keep basic aspects of my life together as laziness, naiveness, lack of work ethic, lack of personal responsibility etc…

<INTERNET HUGS>

I relate to this immensley.

🫂

hey, I’m sorry you’ve been feeling down. I can’t offer a solution, but I just wanted you to know you’re seen. and if you want to talk about it more, absolutely feel free to shoot a message.

fwiw, I absolutely sympathize. I’m a young adult with adhd, and struggling with depression, though the latter is getting better I think. I went pretty quickly from being a “gifted kid” to being what most would consider an underachiever. I don’t, to be clear; I’m proud of where I am, regardless of how it seems to compare to some of my friends. it’s still a mad reality check, though.

on a related note, I left christianity a year ago, and holy fuck has that been an adjustment. most of my optimism was always rooted in religion, and without that worldview, it’s suddenly on me to find new reasons to be even a little hopeful, even to want to be alive. I’m not suicidal, but for a while there I couldn’t say that I wasn’t. I do feel like I’m happy to be alive now, and that’s great, but holy crap this is not as easy as it was when I believed in an all-powerful benevolent god. ah well.

I hope you have a lovely day, but if you don’t, that’s valid too. life isn’t always lovely, and there’s nothing wrong with acknowledging that. there’s nothing wrong with feeling down about it. all we can do is try to support ourselves and one another, y’know?

i’m sorry for the dreams that’ve been taken from you and the injustices you’ve experienced. you deserved better, and so did I, and so did most of us. thank you for being honest about it. 🫂

Thank you so much, I deeply appreciate these kinds of posts that don’t attempt to fix me but just engage in solidarity :)

on a related note, I left christianity a year ago, and holy fuck has that been an adjustment. most of my optimism was always rooted in religion, and without that worldview, it’s suddenly on me to find new reasons to be even a little hopeful, even to want to be alive. I’m not suicidal, but for a while there I couldn’t say that I wasn’t. I do feel like I’m happy to be alive now, and that’s great, but holy crap this is not as easy as it was when I believed in an all-powerful benevolent god. ah well.

I think the least interesting question about religion is whether god exists or not. There are many things you can take away from yourself about christianity that don’t have anything to do with a bearded man in the sky existing or not. It is enough to appreciate the beauty of how a spiritual perspective on life and the beings around you can lead you into a happier, better life even if you that spiritual perspective is fundamentally not reflective of science or reality as we know it.

It is like how I don’t necessarily believe we have souls (I mean whatever, but there is zero scientific evidence of souls or even suggestions that they exist), but the concept of a soul and how it can be affected by the world and other people is an incredibly useful way of looking at the human condition. It is a concept and word that does not derive its power from the fact that it exists, and you can appreciate that outside of believing there is something like a soul literally imbued into ourselves in some magic/spiritual way.

i’m sorry for the dreams that’ve been taken from you and the injustices you’ve experienced. you deserved better, and so did I, and so did most of us. thank you for being honest about it. 🫂

thank you for being honest and listening!

We didn’t do chit… the problem is and always has been, always will be, government.

Well, you gotta be asleep to believe the American Dream, so maybe this means a lot of people are waking up.