Me, an average person: Imagine increasing your net worth.

Imagine your yearly increase being more than inflation

I haven’t seen this in over 7 years… And I’m fucking angry about it, if I’m being honest.

I was in the workforce for over 20 years. Never got a pay raise that matched inflation. Started my own business growing marijuana, and have been able to buy a house and save up a retirement fund in a little over 7 years.

Imagine having a net worth.

Imagine not being worthless

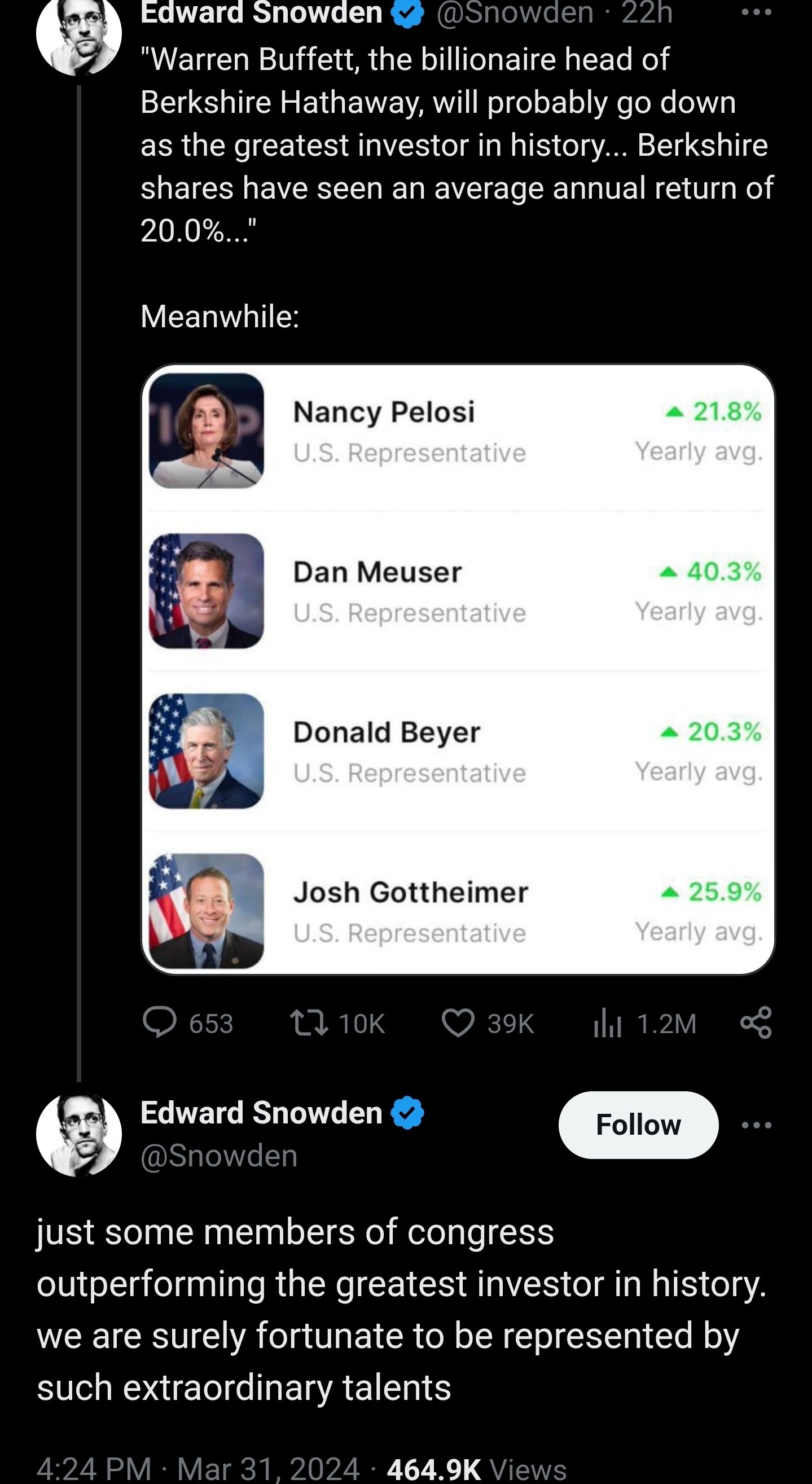

Funny how he puts Pelosi first in the list despite her not being first alphabetically or by returns.

she is certainly the one with the most notoriety. off the top of your head, which party do the rest belong to? which state do they represent?

While it’s not really great that any representative basically gets to do insider trading, it’s frustrating that Pelosi gets most of the heat. It feels very targeted and people complaining about the issue often only complain about her and not the many many other representatives that do the same thing.

They shouldn’t be trading options, which is part of the heat. Normal people don’t do that.

But also, Pelosi’s trades (or her husband’s trades) have mostly been bullish on big name tech companies based around the Bay Area. It just so happens that sector has utterly dominated stock returns in the last few decades, and not even in a surprising way. So that’s not really insider information, but rather adopting an unusually high risk profile for gambling on already successful tech stocks.

This graphic literally includes three more people aside from Pelosi. it is doing the opposite of what you’re frustrated about. it would be more bizarre if it didn’t list the congressperson who is most notable for profiting from insider trading.

It would not be bizarre to see them in alphabetical order. This is such a weird take… But I get your point, and I agree partially with it.

This said, the democratic party has failed all of us here. They are not worse than the Republicans, but they refused to act. https://www.google.com/amp/s/thehill.com/blogs/blog-briefing-room/news/3669259-lawmakers-furious-at-pelosi-after-stock-trading-ban-stalls/amp/

These shitheads are going to hand Trump a second presidency at this rate. Fuck them all.

What ain’t a country I’ve ever heard of

They speak English in what?

Shes is actually perfect for that. She outperformed in 2023, but underperformed in 2022. You would expect a Gaussian distribution around the mean. And if you include every congress member, you get a Gaussian distribution, shifted slightly to the left.

D, R, D, D, in case you were wondering.

Parasite, parasite, parasite, parasite, just to add some explanation.

Edit: An FBI agent contacted me and said that selecting 4 individuals out of 400 in one year is not a statistical anomaly. He also wanted me to tell you that Snowden might be affiliated with Russian government and spread the propaganda

He also wanted me to tell you that Snowden might be affiliated with Russian government and spread the propaganda

No…you mean the guy who stole state secrets and fled to Russia where he was welcomed with open arms might actually be a tool of the Russian propaganda machine to further divide Americans and destabilize our society?

That can’t be. That’s impossible.

Couldn’t be that America had a vested interest in surveillance after 9/11 and overstepped its bounds several times over since then. That’s impossible.

Why can’t both suck?

Like, yeah, Americas domestic surveillance practices were wildly out of line.

That doesn’t make Snowden a saint. What he did benefits Putin far more than it benefits any American and both of them are well aware of that.

Calling out civil rights abuses “benefited the soviets” doesn’t mean that it didn’t need to be done.

What he did benefits Putin far more than it benefits any American

how tho

Because his whole thing is destabilizing the West. What better way to do that than to destroy whatever trust was left in the establishment?

Lmao sure, it’s not America’s fault for violating our trust, it’s his fault for telling us

The destruction of trust is from the establishment that violated it

Removed by mod

Hmm, the real question is whether this is consistent year over year… beating the S&P500 one year doesn’t really indicate anything.

Also there are 535 people in the US congress but only like 30 on these two lists… and not the same 30 both years. How many lost money in those same years?

Removed by mod

Assuming you meant “historical”, then these two years of data imply that ~5% of congress members beat the S&P500 per year, and not the same people every year… which seems statistically insignificant.

Removed by mod

Thanks! This completly debunks the insider trade myth. You would expect a Gaussian distribution around the mean, which would be a market neutral index. And you get even a slightly to the left shifted Gaussian bell curve.

Ah, well there you go then… 25ish people out of 535?

Again, it’d be worrying if the same people were consistently ahead of the market… but that would also be super obvious.

Removed by mod

Damn, Nancy, poor form in 2022.

Brian Higgins thinks prison ain’t shit

Brian Higgins is the prison’s largest investor

Could be all R, could be all D. One thing for certain, they’re all scumbags, S.

Oh so now I can say “both sides?” I thought that was anathema around here.

I’m tired of us not criticizing the democrats for doing the same shit as the republicans because the republicans are worse. “Both sides” never meant both sides are equal, it means both sides are above the “shitty” threshold, even if varying degrees, and many of the problems are bipartisan, shit needs to change all around.

I haven’t met anyone not looking for accountability for D’s on the left. I only hear “Good, if theyre guilty lock them up too”.

“Both sides” is shorthand for “both sides are the same” at least to me. It’s the false equivalency that is the problem – which you’re not doing to be clear.

I definitely have seen a lot of people accusing people of both sidesing for any criticism of dems.

deleted by creator

Brb, programming a bot to copy these ghouls’ investments.

The latency is too much. By the time us plebs get the data, it’s all accounted for

Right they do it before the laws are passed!

LOL those names are instant classics.

There’s like a week or so delay in them having to report trades, by then you’ve missed the profit, drive there’s up a little, and when they sell it drops the price because they have a bunch of shares.

A week later you find out they sold, maybe make a slight profit if your fast. Then you hear what they bought a week and go give them even more money.

Because all the extra money following them, them selling a company could domino into real world consequences at the company like layoffs.

The system is broken. We’re past the point of “gaming” it for scraps. We need a better system or we’re fucked.

People have already tried and failed doing exactly that. Because they aren’t required to report their trades when they’re making them; There’s a significant gap in reporting, so by the time the trade gets reported the stock has already increased/decreased like the congressperson expected.

For instance, let’s say [Generic Congressperson] sees a bill that will help a particular company. They know this bill is going to pass. So they buy stock in the company, vote for the bill, and the stock goes up. They then sell the stock. Three months later, those trades get reported. And now it’s too late, because the company’s stock has already been boosted. So buying now would just be buying after the boost.

This is quiet a bet. All congress members are distributed in a Gaussian distribution around the S&P 500. So copying everyone would just give you the same average. So you would have to pick the members, who outperform consistently. But this changes year over year. For example Pelosi outperformed in 2023, but underperformed in 2022.

And at that point you could just buy individual stocks – or even better: stick to a market neutral ETF.

just pick one that

outperformed every year, or

sits in the right comittees, or

is republican or

is most likely to be corrupt (e.g. gets the most corporate donations)and you can limit yourself to the stocks that are relevant to their positions.

Pretty sure there’s a website that tracks this stuff, job half done.

Wait. Mr Snowden is alive? For real?

In exile

On the run, and became a Russian citizen.

The truth to this aside, the stock market hasn’t ever been like it is over the past decade.

I kind of feel like I suck at trading, but over the past year I’m still up 40.5% by doing almost nothing but keeping mostly the same stocks I’ve had for the past few years. Buffet was able to do it through a ton of years where stocks didn’t climb very quickly as a whole.

Exactly, getting a 20% return on average for years and years is what makes Warren Buffet one of the best Investors. Getting a good year can happen to anyone.

Also, huge gains while investing in 0.001% of a company is one thing. Maintaining those gains when the funds under your control represent major stakes in the companies you invest in, enough to get board seats and move prices by your transactions alone, is another thing entirely.

They just happen to drive policy on what the government spends money on.

Truly enlightened opinion. I don’t agree.

I absolutely agree they shouldn’t be able to hold stocks. But just giving a percentage they made this year doesn’t really tell you anything.

It’s like saying there is no global warming after a colder than usual winter.

Man. I mean I know I’m pathetic in absolutely every way, but it hurts to read that. I have 2 ETFs (vanguard sp500 and emerging markets) and a us bond that I use as a secondary savings account and all they do is lose and occasionally stay flat…

But vanguard s&p500 is up like 25% for the last year, what are you talking about?

It could be the selection of stocks vanguard chose to be part of that ETF that are duds I guess :/

Edit: the below is correct! I got so fed up I stopped looking for a few months. Everything is up!

No, if it’s the s&p500 ETF (VOO in the usa, VUSA in UK) it has the stocks from the s&p500, they didn’t choose anything. It’s just the 500 biggest companies in the US (roughly). Either you don’t have that, or something else is going very wrong.

What are the actual ticker symbols of your investments? Agree with the other user that something isn’t adding up here. You’re likely not invested in what you think you are

I’m in on VanEck semi conductor etf and they’re up 70% for the year :-/

Another etf called WUGI that deals with 5G relates stocks is up about 60%. Those are the two etf’s I have the most in.

Bruh vanguards total market index is up 20% in the past 6 months. The person you’re replying to is an outlier, don’t try to beat the market you will almost certainly lose in the long run.

Pragmatic investing is not exciting or fun. Put your money in index funds and leave it there until you need it.

Roth IRA: Can only put in $6,000 per year by law.

A congressional representatives I can’t remember the name of: Has over 2 million in Roth IRA.

Some law was broken at some point.

Peter Thiel also. As far as I know, he legally contributed to the IRA and then invested the money in his own businesses, which grew several thousand percent.

That’s not necessarily the case. Wasn’t it a big issue recently saying that high tech earners had been putting shares of startups into their Roth IRA then it was worth way more than intended later?

Backdoor Roth conversions + outsized gains like mentioned in the image would pretty easily explain that, which is all “perfectly legal”

In 2012, Mitt Romney had over $100 million in a Roth IRA.

Bad faith or just badly researched meme.

Anyone can make 100% return in a year or two in the stock market. Does that make them corrupt or better than Buffet? Or is it that you need to look at it over a 30 year period.

Fucking morons.

It’s also harder to invest with the amount of funds that Berkshire Hathaway has. The slippage must be a difficult task to manage. Also, they have to make more than 20% because they have to payout the employees and guarantee growth for the investors.

You will most likely be unsurprised to know that Wikipedia describes Dan Meuser as, “an American businessman, politician, and philanthropist serving as the U.S. representative for Pennsylvania’s 9th congressional district since 2019.” In that order. Businessman first.

Edit: Unrelated but sort of related- “In December 2020, Meuser joined over 120 Republican members of the House of Representatives in signing an amicus brief in support of a Texas lawsuit that sought to invalidate Pennsylvania’s 2020 presidential election votes.”

I truly don’t understand this getting spread over and over out to the public and your entire country isn’t in uproar… Oh wait

Everyone in America knows that if you’re making money in the stock market, it must simply be due to the fact that you are very smart. 🙃

Also, because the folks on this list are entrenched House Reps in permanently safe seats, there’s very little to actually be done. I can’t vote against Nancy Pelosi from Texas. You can’t vote against Dan Meuser from Florida. So what is anyone actually supposed to do? Should I raid Dan Crenshaw’s office because Donald Beyer cleaned up? Or should I book a flight to Philly to protest a Congressman I didn’t know existed until today?

I also should note that there’s a certain fudging of numbers here. Buffett has been in the investment game since the 1950s, but - with the exception of Pelosi - all these guys took office in the last 8 years. The NASDAQ market average over the last 8 years has seen a 20% growth average, with a number of years in which it has grown 40% in a single year. If you just showed up in Congress in 2019 and put all your money in The Magnificent Seven or the FAANG stocks (large, stable, popular blue chip firms) you could also outperform Warren Buffet. If you dumped all your money into an S&P Index Fund, you’d be performing comparably. If you just owned Berkshire Hathaway stock starting in 2019, you’d be outperforming Warren Buffet.

So much of the above isn’t Congressmen beating the system, its records starting for a group of Congressmen who happened to take office during the biggest bull run in the market’s history.

Removed by mod

Oooooooh, what’s their secret???

They read Investor’s Business Daily and The Wall Street Journal every day.

Also insider trading, but mostly the first thing. Probably.

Removed by mod

Is it considered insider trading to follow Congress critter trades?